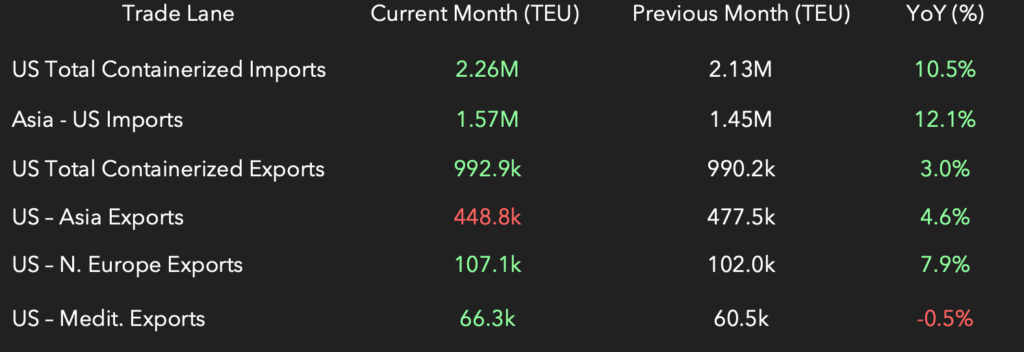

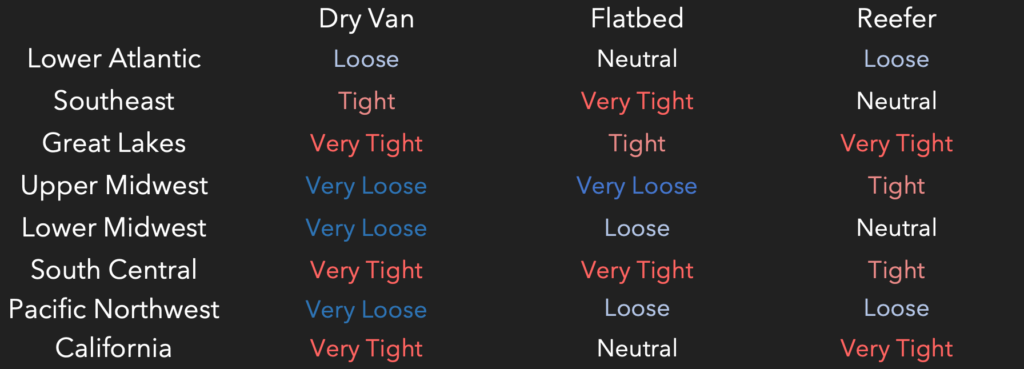

This week, the transportation market experienced minimal changes, with domestic pricing in all modes continuing their slight downward trend. Domestic capacity has also seen incremental shifts, with marginal trends of loosening capacity in the Lower Atlantic and tightening in the Midwest and California. A significant disruption occurred in global trade due to an explosion at the Ningbo-Zhoushan port in China, causing extensive delays and ripple effects across the supply chain, prompting businesses to seek alternative shipping strategies. Meanwhile, the air cargo sector continued its upward trend for the sixth consecutive month, driven by strong demand and supply chain disruptions, raising questions about the sustainability of these conditions as peak season approaches.

We have not seen many changes week over week. Flatbed capacity in the Lower Atlantic adjusted down from Loose to Neutral. Reefer Capacity in the Lower Atlantic shifted from Neutral to Loose. Reefer capacity in the Upper Midwest and California tightened. California changed from Tight to Very Tight. The Upper Midwest changed from Neutral to Tight.

Port Explosion Disrupts Trans-Pacific Trade

In a significant disruption to global shipping, a recent explosion at a major Chinese port has severely impacted trans-Pacific container trade. The blast, which occurred at the port of Ningbo-Zhoushan, one of the world’s busiest cargo hubs, has led to a substantial backlog of container ships and extended delays in cargo handling. This incident has already caused ripple effects across the supply chain, affecting various industries that rely on timely deliveries from Asia. As vessels wait in queue and operational capacity is strained, importers and exporters are bracing for potential delays and increased shipping costs.

The explosion underscores the fragility of international logistics networks and the interconnected nature of global trade. With ongoing disruptions, businesses may need to explore alternative shipping routes with their logistics partners or adjust their supply chain strategies to mitigate delays. The full impact of the explosion is still unfolding, and stakeholders are advised to stay informed about updates from shipping companies and port authorities. As recovery efforts continue, this event highlights the need for resilience and flexibility in global supply chains.

Air Cargo Rates Surge for Sixth Consecutive Month

The air cargo sector continues to experience robust growth, with July marking the sixth consecutive month of rising rates. According to recent data, the demand for air freight has surged, driven by strong consumer spending and supply chain disruptions that continue to impact traditional shipping methods. This ongoing increase in air cargo rates reflects the sector’s resilience and its crucial role in global trade, especially as businesses strive to meet peak season demands. The upward trend in rates is also indicative of the sector’s ability to navigate challenges, from capacity constraints to fluctuating fuel prices.

Looking ahead, the key question for industry stakeholders is whether these positive conditions will persist into the peak season. The sustained growth in rates suggests a strong market, but potential uncertainties, such as geopolitical tensions and further supply chain disruptions, could impact future trends. As the industry adapts to evolving circumstances, companies and logistics professionals are advised to stay vigilant and consider strategic adjustments to optimize their supply chain operations. The air cargo sector’s performance over the coming months will be pivotal in shaping the broader logistics landscape.