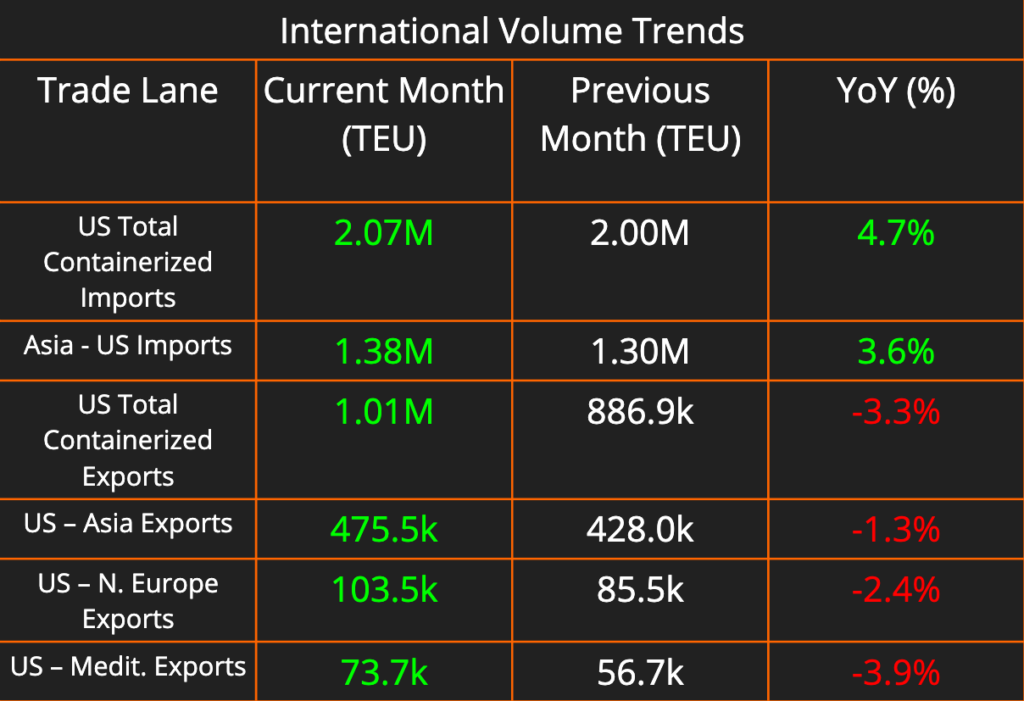

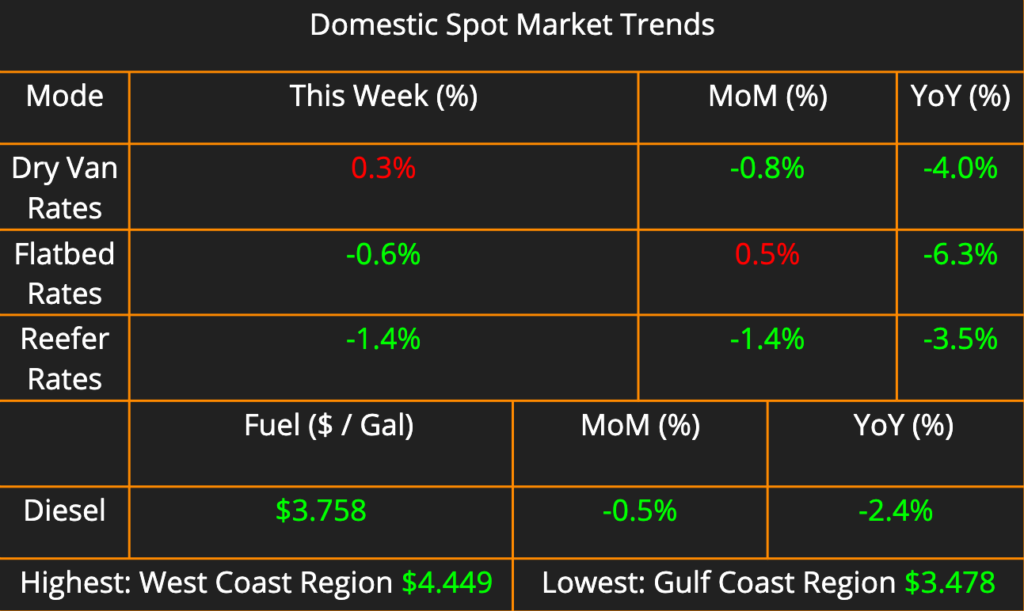

International shipping activity saw a significant uptick in April, with both import and export volumes climbing. Look for updated port volume figures for May in next week’s article. Flatbed and reefer saw declines this week, dropping 0.6% and 1.4%, respectively. Dry van rates continued their upward trend, increasing 0.3% from last week. Diesel prices continue their months-long decline, falling another 1.5% this week compared to last.

This week’s newsletter dives deep into three key issues impacting the transportation industry. First, we examine the strong growth in volumes moving through the US-MX Eagle Pass port of entry and investigate the causes. Then, we provide an update on the status of potential strikes amongst Canadian Border Patrol agents, which may impact border crossings in June. Finally, we discuss the proposed 25% average price increase for USPS Parcel Select.

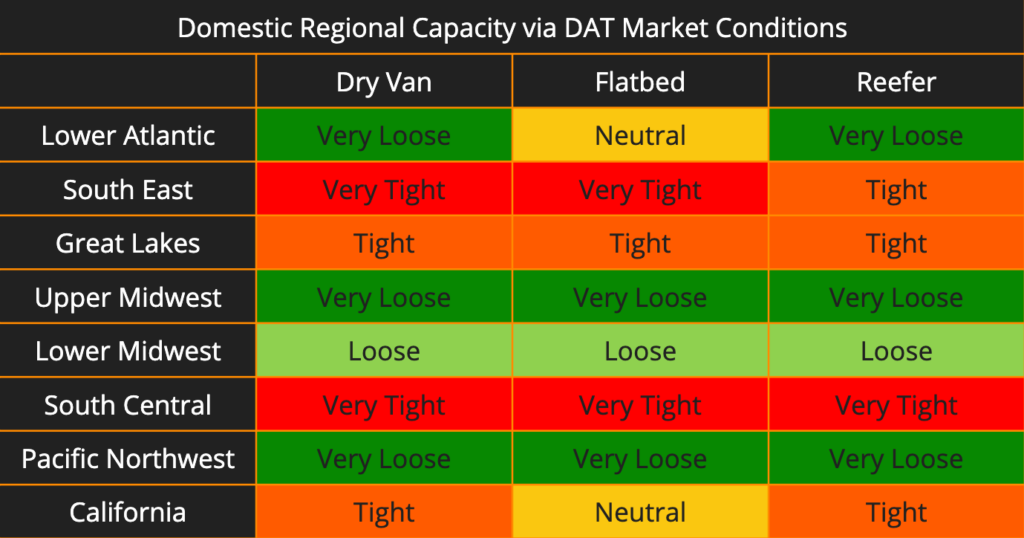

The story of this week’s regional capacity matrix is one of stability, we saw no significant swings in capacity across the country. In the Great Lakes region, the only change was with dry van capacity moving from Neutral to Tight to match the other two modes. In the Lower Midwest region, we saw Dry Van and Reefer capacity both change to Loose. California dry van and South Central reefer capacity loosened, reverted to tight from very tight.

Eagle Pass Soars as Fastest-Growing U.S. Border Crossing

The Port of Eagle Pass, Texas, has emerged as the nation’s fastest-growing trade gateway, according to Census Bureau data analyzed by WorldCity. This Texas border town, located 140 miles southwest of San Antonio, has seen a remarkable 22% year-over-year increase in trade compared to the first three months of 2023. Eagle Pass’ growth surpasses all other major U.S. airports, seaports, and border crossings.

While Eagle Pass reigns supreme in growth rate, Port Laredo, Texas, remains the country’s top port in terms of total trade volume. For the first quarter of 2024, Laredo recorded a 2% increase in two-way trade.

Driving Eagle Pass’ surge are imports like commercial vehicles ($2.5 billion), passenger vehicles ($2 billion), and beer ($906 million). The port’s leading exports so far this year include auto parts ($307 million), gasoline ($289 million), and soybeans ($215 million).

Experts attribute Eagle Pass’ success in part to recent railroad mergers and partnerships.

The 2023 merger of Canadian Pacific and Kansas City Southern, along with Union Pacific’s collaboration with Ferromex, have created a more efficient rail network connecting Eagle Pass to key points in Mexico and Canada. This improved infrastructure has fueled a significant rise in automotive imports from Mexico.

Potential Strike at Canada Border Services Agency: What Businesses Need to Know

Members of the Public Service Alliance of Canada (PSAC) working for the Canada Border Services Agency (CBSA) have overwhelmingly voted in favor of striking, potentially starting as early as June. This raises concerns for businesses that rely on smooth cross-border trade with Canada.

While the government emphasizes its commitment to reaching a negotiated agreement and highlights upcoming mediation sessions, the possibility of a strike remains. Per Treasury Board of Canada Secretariat, “The Government of Canada values the important work of border services employees, and we will do everything possible to reach a responsible and competitive agreement. However, in the event of strike action, Canadians should know that 90% of front-line border services employees are designated as essential, meaning they must continue providing services during a strike.”

USPS Parcel Select Price Hike: Shipping Costs Face Shakeup

The U.S. Postal Service (USPS) is proposing a significant 25% average price increase for its Parcel Select service, a move that could impact businesses and shipping partners.

What is Parcel Select?

Parcel Select is a popular ground delivery option used by companies like DHL eCommerce and Pitney Bowes. These consolidators handle packages and send them to USPS facilities for final-mile delivery.

The Proposed Changes:

- Price Increases: The proposed hike varies depending on where packages enter the USPS network. Packages entered at delivery units, the final stop in USPS’ network before packages are delivered to customers, will see the highest increase at 43.4% on average.

- Shifting Incentives: The USPS aims to incentivize consolidators to inject packages further upstream in its network, making better use of its infrastructure.

- Potential Impact: Experts warn of potential delays and cost increases for shippers relying on consolidators. Smaller companies might even seek alternative delivery providers.

USPS’s Perspective:

The Postal Service expects the price hike to generate 1.5% more revenue in fiscal year 2025 but anticipates a 2% decline in Parcel Select volume. They believe large shippers will continue to benefit from negotiated discounts, minimizing the impact for some.

Next Steps:

The Postal Regulatory Commission will review the proposed changes before they take effect on July 14th. This shakeup in Parcel Select pricing could have significant implications for businesses and the shipping landscape.