This week’s transportation news offers a mix of headlines. Contract talks between East Coast dockworkers and maritime employers have stalled, raising concerns about disruptions at key ports. However, ports in Los Angeles and Long Beach, despite experiencing a dip in cargo volumes, anticipate a rebound in the coming months. Additionally, the transportation industry is buzzing with M&A activity as major players like FedEx and UPS reshape their operations.

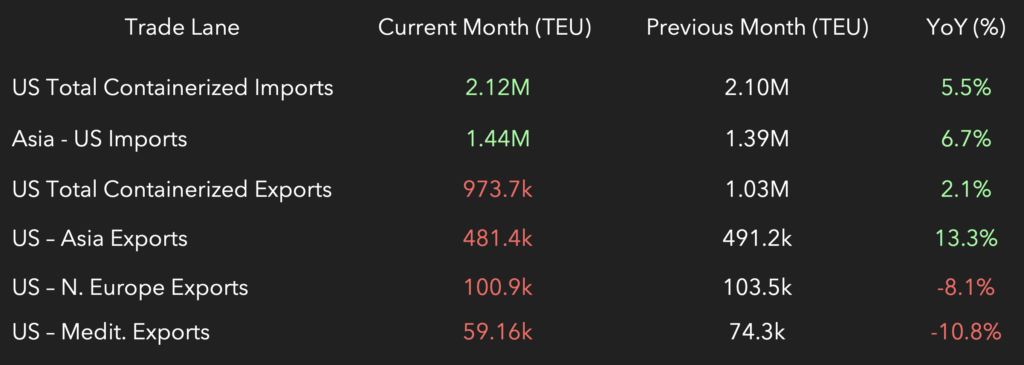

International Volume Trends

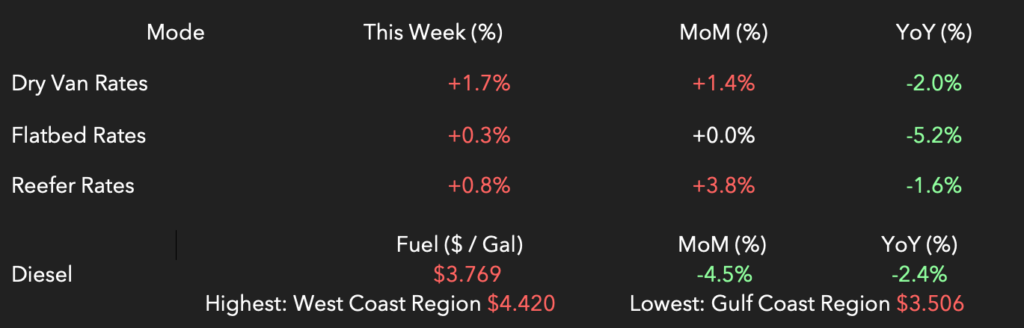

Domestic Spot Market Trends

Domestic Regional Capacity via DAT Market Conditions

Overall, the mode with the biggest change in capacity is flatbed. We saw the Lower Atlantic region change from Neutral to Loose. The Great Lakes changed from Tight to Neutral. The Pacific Northwest shifted from Neutral to Loose as well. There have also been some changes in the reefer market that we have noticed. While The Southeast region is still marked as very tight, we can confirm based on carrier conversations that this region is beginning to loosen up as Outbound Produce grinds to a halt and freight dries up.

East Coast Dockworkers’ Contract Talks Stall, Businesses Urge White House Intervention

Negotiations on a new contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) have stalled, raising concerns of a potential work stoppage at East Coast ports as the September 30th expiration date approaches. This has prompted a coalition of businesses and trade groups to urge the Biden administration to intervene and help get talks back on track.

The ILA represents roughly 45,000 dockworkers on the East and Gulf Coasts, while the USMX bargains on behalf of maritime employers. Both sides had initially hoped to begin master contract negotiations this summer after finalizing local port agreements. However, progress hit a snag when the ILA accused Maersk, a USMX member, of violating the current contract by implementing an automated gate system at a Mobile, Alabama terminal. The ILA argues this system eliminates jobs and contradicts the existing agreement on technology.

A letter signed by 161 organizations, including the US Chamber of Commerce, National Retail Federation, and various industry groups, was sent to the White House this week. The letter implores the administration to “provide any and all support to the parties in their negotiations” to avoid disruption to port operations.

Businesses are particularly concerned about a potential repeat of the West Coast labor dispute in 2022 and 2023. The eastward shift of cargo during that period is now reversing, with companies increasingly opting for West Coast ports due to the established long-term contract there.

“We are starting to see a shift back to West Coast gateways, where a long-term contract is in place, especially as we enter the busy peak shipping season,” the letter states. Businesses are urging the White House to act swiftly to prevent disruptions during this crucial time for imports and exports.

This request follows a similar plea made by the National Retail Federation in January. Whether the ILA will welcome White House involvement remains unclear. The union is likely weighing its options, particularly as the negotiation falls during an election year.

Cargo Volumes Dip at LA and Long Beach, But Recovery Expected

Cargo volumes at the Ports of Los Angeles and Long Beach dipped slightly year-over-year in May, but both port authorities anticipate a rebound in the coming months.

- Los Angeles: The Port of Los Angeles processed 752,893 TEUs (twenty-foot equivalent units) in May, a 3% decrease compared to May 2023. Despite the dip, Port Director Gene Seroka expressed optimism for a busier summer, citing forecasts indicating “more robust activity on our docks.”

- Long Beach: The Port of Long Beach saw a steeper decline, handling 695,937 TEUs in May, down 8% year-over-year. Officials attributed the decrease to shifting trade routes and cancelled voyages. However, Port of Long Beach CEO Mario Cordero remains confident, stating they will “recapture business” through industry collaboration and continued high-quality service.

While May volumes showed a slowdown, both ports project a stronger performance in the latter half of 2024.

M&A Activity Heating Up in Transportation Industry as FedEx Considers Spin-Off, UPS Sells Off, and TFI Expands

The transportation and logistics industry has witnessed a flurry of mergers and acquisitions (M&A) activity in the past week, potentially signaling the tail-end of a freight recession. These moves come as major players like FedEx, UPS, and TFI International (TFI) re-evaluate their strategic priorities.

FedEx ponders spin-off of golden goose: Industry leader FedEx is exploring the spin-off of its highly profitable FedEx Freight division, the largest less-than-truckload (LTL) carrier in the U.S. This strategic review aims to maximize shareholder value by capitalizing on FedEx Freight’s impressive margins, which significantly outperform other company sectors. Analysts believe an independent FedEx Freight could unlock even greater value as a publicly traded company.

UPS sheds Coyote Logistics: Meanwhile, rival UPS recently announced the sale of its struggling truckload brokerage business, Coyote Logistics, to RXO for $1.025 billion. This move allows UPS to focus on its core business of small package delivery and logistics partnerships. The sale comes after UPS acquired Coyote Logistics in 2015 for $1.8 billion.

TFI on a buying spree: On the other hand, TFI International is actively expanding its footprint through acquisitions. In quick succession, TFI acquired flatbed carrier Daseke for $1.1 billion, less-than-truckload carrier Hercules Forwarding, and most recently, food-grade tank hauler Entreposage Marco. These strategic moves suggest TFI might be contemplating a spin-off of its specialized truckload assets into a separate public company.