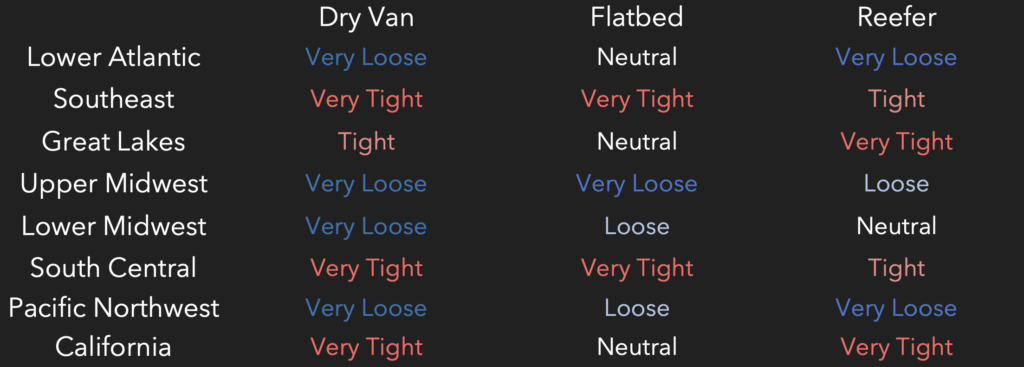

Happy 4th of July to our clients and readers! Despite the usual holiday chaos, the logistics industry is experiencing several macro trends impacting the market. Unsurprisingly, domestic spot rates across all modes surged last week. Our North American capacity chart reveals a tale of extremes, with most regions falling into either “Very Loose” or “Very Tight” categories.

Meanwhile, an ATRI report highlights the significant cost increases truckers faced in 2023, driven by rising insurance costs and driver wages. However, a glimmer of hope emerges from the Logistics Managers’ Index, which reports an improving freight market and signs of an imminent freight market recovery.

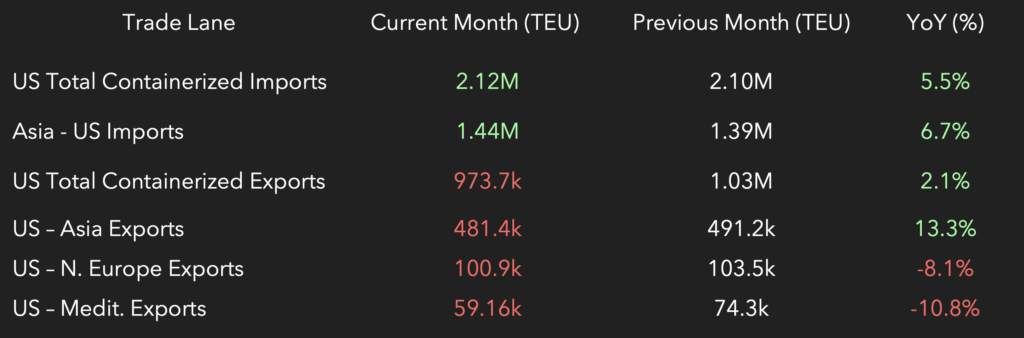

International Volume Trends

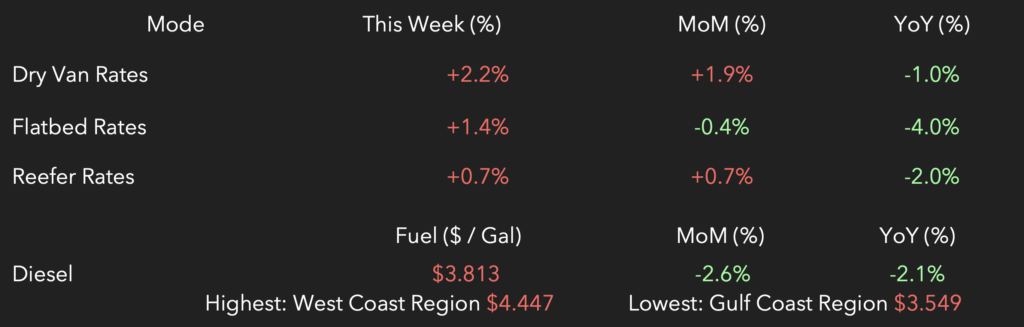

Domestic Spot Market Trends

Domestic Regional Capacity via DAT Market Conditions

Trucking Industry Costs Rise Despite Falling Fuel Prices, ATRI Report Finds

The American Transportation Research Institute (ATRI) released a new report detailing the operational costs of trucking in 2023. Despite a nearly 9% reduction in fuel costs, truckers saw an overall increase in operating costs, driven primarily by rising insurance costs and driver’s wages.

Key Findings:

- Total Cost Increase: The total marginal cost of operating a truck in 2023 reached a record high of $2.27 per mile, despite an 8.8-cent decrease in fuel costs compared to 2022. This translates to a modest 0.8% increase in overall costs year-over-year.

- Non-Fuel Costs Rise Sharply: Excluding fuel, trucking expenses rose by a significant 6.6% in 2023. This increase came during a period of economic softness in the freight market, exceeding expectations.

- Driver Wages Climb: Driver wages emerged as a key driver of cost increases, growing by 7.6% to $0.779 per mile in 2023. This trend was particularly prominent in the less-than-truckload (LTL) sector due to market shifts and union contract negotiations.

- Truck Insurance Premiums Spike: Unlike other cost categories, truck insurance premiums witnessed a significant jump of 12.5% in 2023, breaking a two-year trend of minimal change.

- Profitability Takes a Hit: The combined effect of rising costs and declining freight rates led to a squeeze on profitability across the industry. Operating margins, a key metric for financial health, saw a significant decrease. In the truckload sector, margins plunged from 8% in 2022 to only 3% in 2023. The refrigerated transport sector mirrored this trend, with margins falling from 6% to 2%.

Looking Forward:

The ATRI report paints a complex picture of the trucking industry in 2023. While falling fuel costs provided some relief, rising non-fuel expenses and a weak freight market created a challenging environment for profitability. However, early signs of cost moderation in 2024 offer a cautiously optimistic outlook for the future.

Logistics Market Shows Signs of Recovery, But Experts Remain Cautious

The latest Logistics Managers’ Index (LMI) report suggests a potential turning point for the freight market, with transportation pricing trending upwards for the second consecutive month. This comes after a period of contraction, often referred to as the “freight recession,” that began in Spring 2022.

Key Findings:

- Transportation Capacity: The LMI’s transportation capacity subindex remained flat at 50 in June, marking the first time in over two years that it hasn’t shown growth. While not yet declining, this indicates a potential stabilization in capacity and demand.

- Transportation Pricing: The transportation pricing subindex reached its highest level since June 2022, rising to 61. This suggests shippers are facing higher transportation costs, due in part to a surge in ocean shipping spot rates.

- Inventory Levels: Inventory levels remained in contraction territory, with a reading of 47.4. However, there’s a notable difference between upstream (manufacturers and wholesalers) and downstream (retailers) firms. Upstream firms are building inventories (51.5), while downstream firms are actively running them down (37). This could indicate retailers are focusing on cost control and just-in-time inventory management, while manufacturers are preparing for the upcoming peak season.

- Warehouse Capacity and Utilization: Warehouse capacity (52.6) and utilization (52.6) both declined in June, suggesting tighter space availability.

What it Means:

The LMI data paints a mixed picture. While transportation pricing suggests a potential market recovery, the declining warehouse metrics indicate some ongoing challenges. The report highlights that the “freight recession” may not be officially over yet, but the current trends could be the start of a rebound.