The freight industry continues to navigate a complex landscape as we enter the opening stretch of peak season. We’ll start with some positive news: domestic prices and fuel rates are cooling down, and freight capacity is easing up. But challenges persist. We’ll explore the growing threat of freight fraud, which is becoming increasingly sophisticated and costly. And finally, we’ll examine how severe weather events off the southern Coast of Africa and ongoing disruptions in the Red Sea are leaving ocean carriers and shippers with few stable routing options.

International Volume Trends

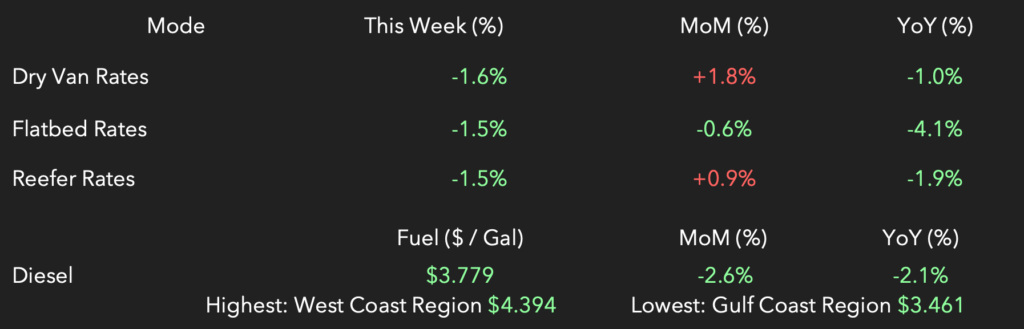

Domestic Spot Market Trends

Domestic Regional Capacity

Following a similar trend throughout the past month, there weren’t any drastic changes in domestic markets week to week. Capacity has generally loosened across the van and flatbed freight, while reefer capacity remained flat compared to last week. Flatbed capacity remained steady across all regions other than the Great Lakes region, which was downgraded from Tight to Neutral. Reefer capacity remains neutral in Southeast, this continues the trend from last week of a gradual loosening in capacity with regional produce season wrapping up.

Freight Fraud: A Growing Epidemic

Freight fraud has evolved from a nuisance to a sophisticated, organized crime plaguing the transportation and logistics industry. Schemes like double brokering, once a simple problem, have become complex, often involving identity theft and the exploitation of digital platforms. Organized crime rings target retailers, stealing billions of dollars worth of merchandise through elaborate supply chain infiltration. These criminals leverage technology, such as phishing emails and load board manipulation, to execute their plans.

Recent trends include scammers targeting carriers with fake emails and fraudulent broker onboarding processes to steal sensitive information like DOT PINs. Despite the increasing sophistication of these schemes, the root of the problem often lies in a lack of transparency within the industry. Digital platforms, while facilitating efficiency, have also created opportunities for fraudulent activities.

Industry and Government Struggles to Combat Fraud

To combat this growing threat, various solutions have emerged. Technology companies offer identity verification and fraud prevention platforms, but these tools are often seen as partial solutions rather than definitive answers. Industry leaders emphasize the importance of collaboration and transparency to mitigate risks. However, the effectiveness of these measures is hindered by the complex nature of freight fraud and the challenges of cross-agency cooperation.

Government agencies like the FMCSA have limited authority to address the issue, and their efforts have been hampered by bureaucratic hurdles and insufficient resources. While regulations exist, their enforcement is often delayed or hindered by jurisdictional disputes. This lack of a unified front has created a permissive environment for fraudsters to thrive.

A Call for Collaboration and Innovation

Ultimately, solving the freight fraud crisis requires a multi-faceted approach involving industry, technology, and government. Increased collaboration among stakeholders, including shippers, carriers, brokers, and law enforcement, is crucial. Technology providers must continue to innovate and develop more robust fraud prevention tools. And government agencies need to enhance their capabilities and coordination to effectively combat these criminal activities. Only through a concerted effort can the industry hope to turn the tide against freight fraud and protect its stakeholders.

South African Storms Compound Red Sea Disruptions

Severe weather conditions off the coast of South Africa last week further disrupted global supply chains already grappling with challenges posed by the ongoing conflict in the Red Sea.

A combination of factors has created a perfect storm for shipping companies. Extreme weather, including waves over 33 feet high, brought vessel movements to a complete standstill around the Cape of Good Hope. This came on top of existing delays caused by ships rerouting to avoid Houthi rebel attacks in the Red Sea.

Weather experts warn that the situation could worsen as another cyclone is expected to hit the region later this week. The added pressure on shipping routes has resulted in port congestion, longer transit times, and increased costs for businesses.

The impact extends beyond container ships. A bulk carrier, the MV Ultra Galaxy, was abandoned northwest of Cape Town last week, highlighting the perilous conditions faced by seafarers.

While the focus has been on the South African coast, it’s important to note that ports in Texas were also closed earlier this month due to Hurricane Beryl. These events highlight the increasingly common supply chain disruptions caused by severe weather.