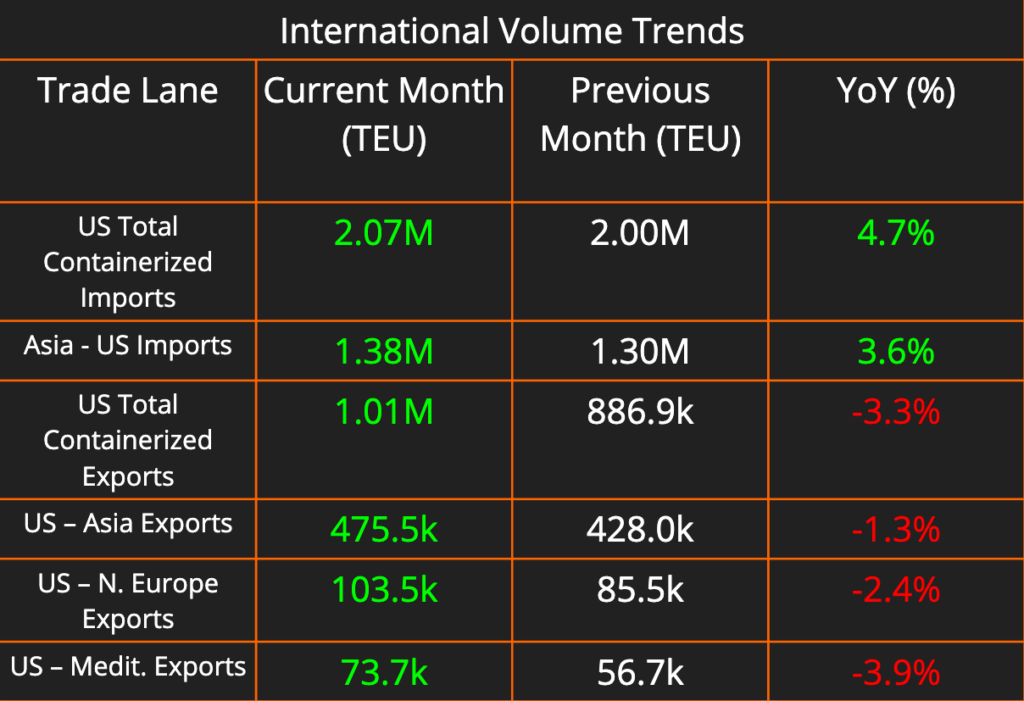

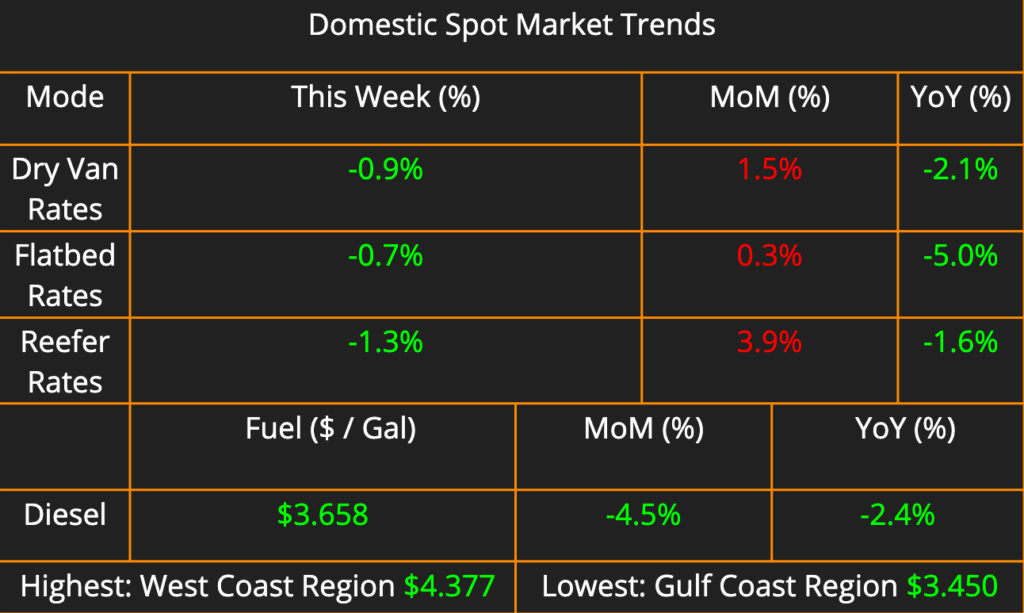

International shipping data continues to show a surge in activity, strengthened by an earlier-than-usual peak import season. Domestic pricing in all modes decreased slightly compared to the preceding week but remain up month-over-month. Our capacity index shows significant tightening in across all modes in California. Diesel prices had another great week, continuing their downward trajectory, falling another 8 cents per gallon compared to last week.

This week’s transportation news offers a mix of trends. The truckload market hints at a summer demand increase with rising contract tenders, though spot rates lead the way in pricing. Across the Pacific, a trans-Pacific shipping boom fueled by high demand sees established and returning carriers launch new Asia-Americas routes, raising concerns of pre-pandemic congestion. Finally, a potential border crisis on the US-Canada border is averted with a tentative agreement between agents and the government.

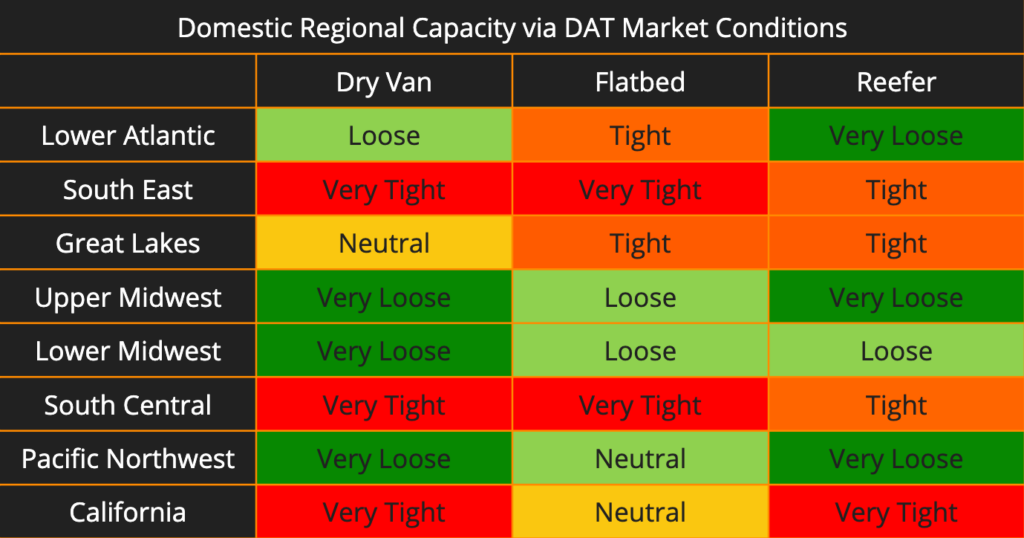

We’ve observed a few key shifts in domestic outbound capacity this week. Great Lakes dry van capacity seems to be easing, transitioning from “tight” to “neutral” compared to the previous week.

In contrast, California, in all markets other than flatbed, is experiencing significant tightening. Both dry van and reefer capacity in the region have jumped from “tight” to “very tight,” indicating a dramatic change in a typically data-rich market.

Truckload Market Heats Up With Summer Demand

What’s Happening

While the nationwide truckload market is still dealing with one of its worst freight recessions on record, industry data points to the possibility of a gradual turnaround in the works. FreightWaves’ Outbound Tender Volume Index (OTVI) shows volumes increasing by 7.1% from 5/26-6/3, which would indicate one of the most significant increases in demand to start the summer shipping season since before the COVID shutdowns of 2020. OTVI is a measure of the electronic tenders from shippers to carriers, skewed towards contract freight between large carriers and large shippers.

What It Means

While contract shipment tenders are increasing, rates have not yet increased proportionally. Instead, they’re staying level. The main reason for this? Since the domestic truckload market has seen supply vastly outstrip demand (more trucks than freight) since mid-2022, there is still enough truck capacity to service the increased tender levels. Where increases are occurring is on the spot rate market, which has hovered around

4%-7% higher YoY since early May 2024. For January-April 2024, rates had been lower than they were in 2023. Each year, we see certain milestone events that push spot rates up and down. In May, the market commonly sees increases on the spot market for International Roadcheck Week and Memorial Day, and 2024 was no exception, as those events drive rates up to levels held through early June. The big takeaway? The changes to the market are not happening overnight. While demand has ticked up for capacity to haul contract freight, and rates are increasing slightly on the spot market, shippers across the board are still seeing shipper-friendly rates and capacity levels overall.

What’s Next

While the recent increases in contract tenders and spot rates are small signs of an improving economy and a stabilized truckload market, we are still a long way from the capacity crunch (and corresponding elevated rates) of the COVID era. FreightWaves’ Outbound Tender Rejection Index (OTRI) – a metric showing the percentages of contract tender requests that are rejected by carriers – is an accurate indicator of how balanced the market is in a given period. During non-holiday periods, OTRI of 5%-7% is the “sweet spot” where carriers have enough bargaining power to price themselves to profitability, while shippers can still expect more predictable pricing over the long term. With rejection rates below 5% for most of the last 2 years, and still below that threshold after the recent spike in volume, capacity is expected to remain readily available for shippers.

Trans-Pacific Trade Booms as Carriers Rush Back In

The trans-Pacific shipping market is experiencing a resurgence, fueled by surging cargo demand and soaring freight rates. This has attracted both established long-haul carriers and intra-Asia carriers who had previously withdrawn from the route.

Intra-Asian Carriers Return After Hiatus

Several intra-Asia carriers, including Singapore and Dubai-based SeaLead Shipping, China’s BAL Container Line, and Taiwan’s TS Lines, are re-entering the trans-Pacific trade lane after an 18-month absence. This move reflects the strong market conditions, with US retailers revising their import forecasts upwards through September.

Major shipping lines are also capitalizing on the boom. Companies like Cosco Shipping Lines, Wan Hai Lines, Maersk, and Mediterranean Shipping Co. (MSC) are launching new services connecting Asia and the Americas. This includes routes to the US West Coast, East Coast, Latin America, and Canada.

Analysts warn that the current market bears a resemblance to the pre-pandemic period, with port congestion, high demand, and tight capacity emerging as key concerns.

Services Recently Announced

· SeaLead’s Asia West Coast (AWC) service launches this week, offering a route between South China and Long Beach with a transit time of 25 days eastbound and 18 days westbound.

· BAL Container Line restarts its China-Mexico Express (CMX) and China Pacific Express (CPX) services, connecting South China with Mexican ports.

· Taiwan’s Wan Hai Lines launches its US West Coast Asia America 1 (AA1) service, calling at key Chinese and US ports.

· Cosco Shipping Lines and OOCL launch a new China-Pacific Northwest Coast/Vancouver (CPV) service.

· Maersk revamps its Asia-Latin America (AC) services with new routes connecting China, South Korea, and Latin American destinations.

· MSC launches its Carioca service, offering weekly connections between Asia and Brazil.

Border Crisis Averted: Canadian Border Agents Reach Tentative Deal

Canadian border agents have reached a tentative agreement with the government, narrowly avoiding a strike that could have significantly disrupted cross-border trade.

The deal, announced by the Public Service Alliance of Canada (PSAC) and the Customs and Immigration Union (CIU), prevents a work stoppage that was scheduled for Friday morning. A strike would have likely caused delays for shippers and traffic congestion at key border crossings.

Details of the agreement, which includes wage increases and other benefits for border agents, will be released once ratified by union members. Both PSAC and CIU represent over 9,500 border services employees who have been working without a contract for the past two years.

The Canadian government expressed satisfaction with the agreement, stating it reflects “common ground” between the parties. Industry experts anticipate a swift return to normal operations at border crossings.