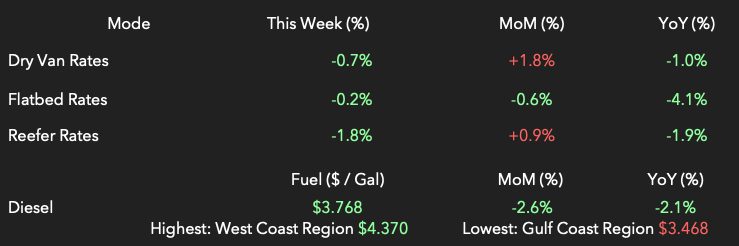

In this issue, we delve into several key developments affecting the freight and shipping markets. Domestic freight rates across all modes have continued to fall, with national average diesel prices also dropping. Notably, the Gulf Coast region saw a slight increase in diesel prices, diverging from the nationwide trend of falling fuel costs. Carrier earnings calls from major carriers like Landstar, Werner, and Knight-Swift indicate early signs of market stabilization. Additionally, the U.S. government is replenishing the Strategic Petroleum Reserve with a purchase of 4.65 million barrels of crude oil, a move aimed at bolstering national energy security. Lastly, the U.S. Trade Representative has delayed planned tariff hikes on Chinese imports in response to concerns from industry stakeholders.

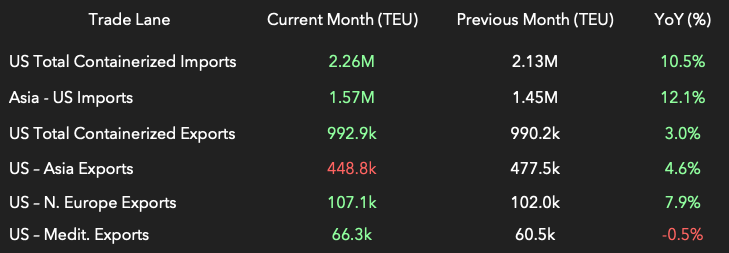

International Volume Trends

Domestic Spot Market Trends

Domestic Regional Capacity

There are a few subtle changes to the capacity matrix this week, but overall, very similar to last week. In the Lower Midwest, we saw flatbed capacity loosen up in the Flatbed mode. In California there were two changes; reefer capacity loosened from Very Tight to Tight and Flatbed capacity from Tight to Neutral. Overall, we can observe that capacity is loosening up a little bit in this freight hotspot, although Dry Van Capacity is still Very Tight.

Carrier Earnings Calls Signal Recovering Domestic Market

We are closely monitoring carrier earnings calls this month, as they offer valuable insights into the current domestic freight market. For shippers, these calls are crucial as they indicate potential shifts in rates and capacity, which directly impact shipping strategies.

In recent earnings reports, major truck carriers Landstar, Werner, and Knight-Swift pointed to early signs of market stabilization, though financial results were mixed. Landstar System saw a decline in volumes and revenue in Q2 but noted some stabilization in truckload rates and improving yields, though it remains cautious with its outlook and anticipates ongoing capacity reductions as smaller carriers leave the market.

Werner Enterprises acknowledged that the market is nearing an “inflection point,” but it has not yet fully turned. The company reported lower revenues and fleet reductions, but sequential improvements in financial metrics were encouraging. For shippers, this suggests that while the market stabilizes, capacity could become more constrained, potentially leading to higher rates.

Knight-Swift Transportation expressed cautious optimism that the worst of the freight cycle may be over, focusing on strategic expansions in its less-than-truckload business. The company’s acquisition of U.S. Xpress has strengthened its position, but shippers should note that Knight-Swift’s cautious outlook implies rates may rise slightly as the market recovers and capacity tightens.

Overall, shippers should prepare for a shift in the market environment where slight rate increases and reduced capacity could make securing transportation for their shipments more challenging.

U.S. Expands Strategic Petroleum Reserve with New Oil Purchases

On July 29, the White House announced the purchase of 4.65 million barrels of crude oil to replenish the Strategic Petroleum Reserve (SPR), continuing efforts to restore the reserve, which hit a 40-year low following extensive drawdowns in response to global events.

In 2022, the Department of Energy released a record 180 million barrels from the SPR to address rising gasoline prices due to Russia’s invasion of Ukraine. Since then, efforts have been underway to refill the reserve, with recent purchases timed to take advantage of a drop in crude oil prices of about 10% since early April. This timing suggests that officials may be betting that current market conditions represent a near-term bottom in oil prices, making it an advantageous moment to buy.

Deputy Energy Secretary David Turk confirmed the commitment to replenishing the reserve: “We will keep buying back… and try to buy back as much as we are capable of buying back.”

The latest contracts, awarded to Exxon Mobil and Macquarie, average $77 per barrel. These purchases bring the total amount bought to 43.25 million barrels. The Department of Energy has also accelerated the return of 5.5 million barrels previously loaned to oil companies.

The new oil will be delivered to the SPR’s Bayou Choctaw storage site from October 1 through December 31. The reserve currently holds 375 million barrels, down from about 600 million barrels at the start of 2022.

This strategic timing not only reflects a focus on national energy security but also indicates a calculated move to leverage favorable market conditions for replenishing the reserve.

U.S. Trade Representative Delays Tariff Increases on Chinese Imports Amid Industry Concerns

In an announcement on Tuesday, July 30th, the U.S. Trade Representative (USTR) has decided to delay the implementation of significant tariff hikes on various Chinese imports. Initially scheduled to take effect this Thursday, the tariffs are now under further review, with a final decision expected by mid-August. If approved, the tariffs will come into effect two weeks later.

This move comes in response to a flood of feedback from industry stakeholders. USTR has reported that it is carefully considering over 1,100 comments received during a public comment period, which has contributed to the decision to extend the review period.

In May, the White House had announced plans to increase tariffs on a wide range of Chinese goods under Section 301 of the Trade Act of 1974. This action was intended to address concerns about China’s trade practices and their adverse effects on U.S. workers and businesses. The proposed tariffs include a 100% duty on Chinese-made electric vehicles, a 50% tariff on semiconductor chips, and a 25% increase on ship-to-shore cranes, among other products.

The tariff increases were to be phased in over the next three years, with several, including those on electric vehicles, solar cells, steel, aluminum, and medical products, set to take effect in 2024.

However, the plan has met with substantial opposition from port authorities, terminal operators, and industry groups. Notably, the Port Authority of New York and New Jersey and Port Houston have expressed concerns about the impact of the proposed tariffs on the cost and availability of ship-to-shore cranes. These cranes are essential for port operations, and the imposition of a 25% tariff could increase their cost by up to $4.5 million each, according to Port Authority estimates.

Port Houston, for instance, recently placed an order for eight dockside electric ship-to-shore cranes from Shanghai Zhenhua Heavy Industries Co. for over $113 million. This order, the largest in the port’s history, is now threatened by the potential tariff increase.

The American Association of Port Authorities (AAPA) has also voiced strong opposition to the tariff increases, arguing that they could lead to significant adverse outcomes, including harm to port efficiency, strained supply chains, higher consumer prices, and a weakened U.S. economy.

As the USTR continues its review process, the outcome of this decision will likely have far-reaching implications for U.S. ports and the broader trade landscape. The delay provides additional time for stakeholders to present their case and for the USTR to weigh the potential economic impacts of the proposed tariffs.