February 16th, 2024

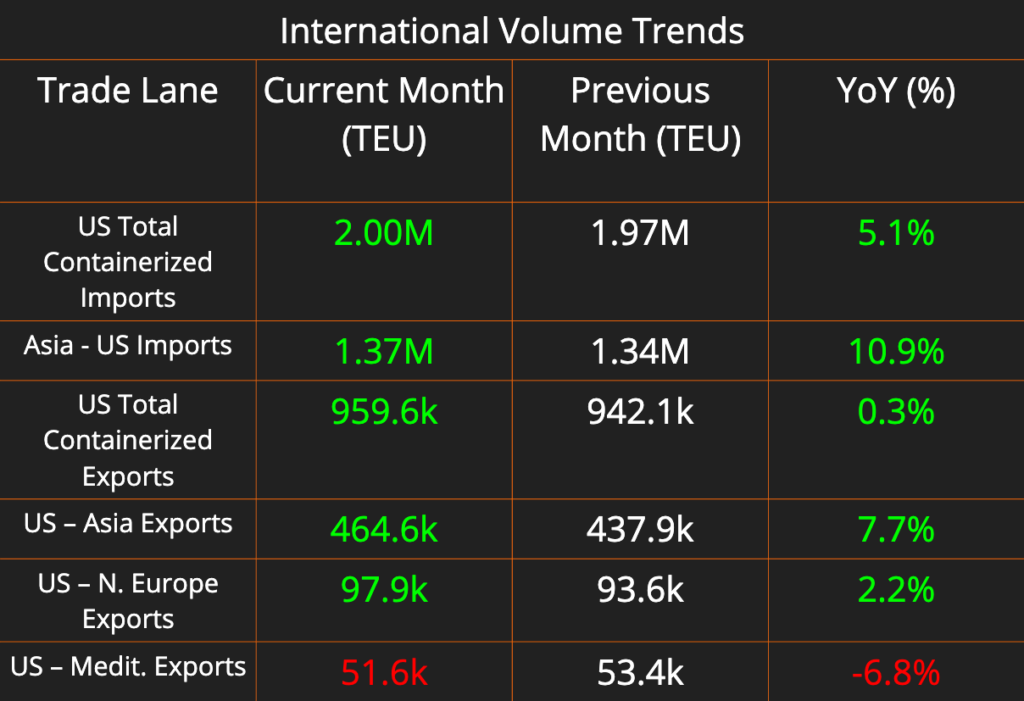

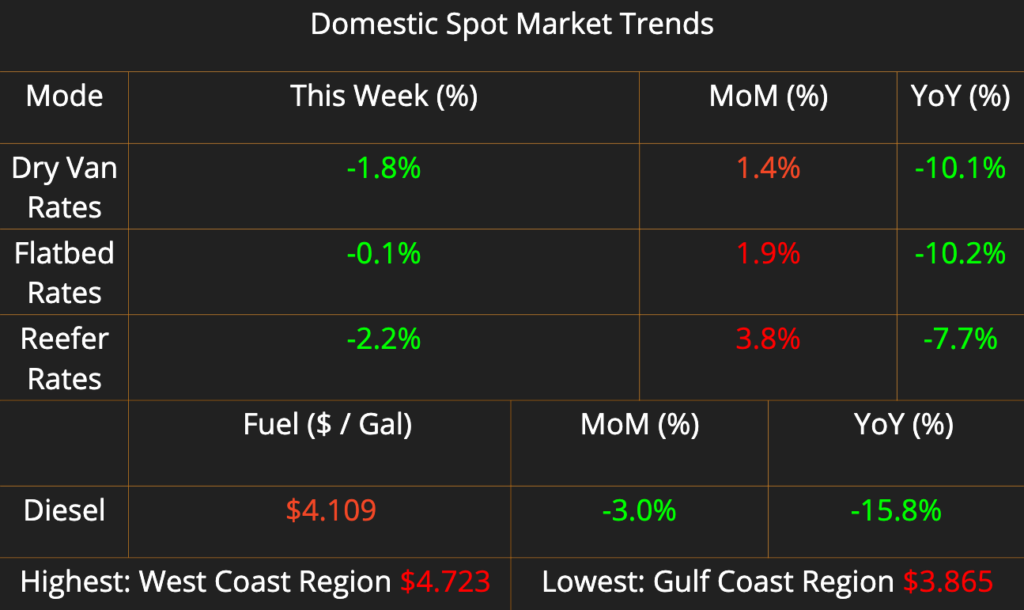

In this week’s newsletter we updated the trends we’re seeing in international volumes, the domestic spot market, and the domestic capacity market. Also, NPL joins EPA’s SmartWay Partnership to reduce emissions. The Port of Los Angeles sees robust import growth despite challenges. US warehouse rates continue their surge, driven by low vacancy rates and strong demand, coupled with a smaller construction pipeline.

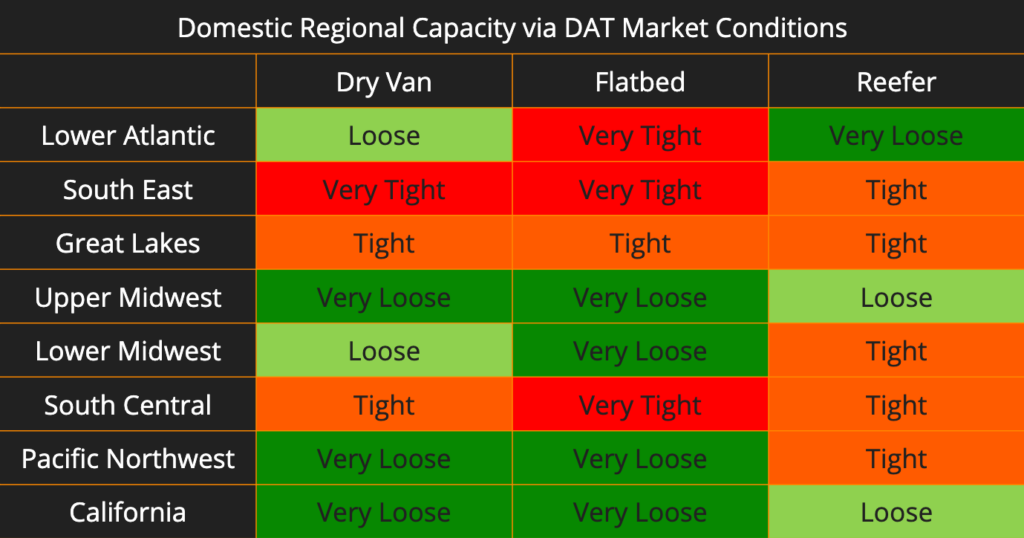

Some newer trends this week compared to last, Reefer capacity looks to have tightened up significantly across the country with 5/8 observed markets categorized as tight. Flatbed and Reefer capacity is split depending on the region but relatively polar with many regions continuing to veer towards the extremes (Very Tight vs. Very Loose). As a note, produce season is on the horizon. Look for significant capacity changes into and out of the Southeastern United States as produce gets harvested and processed.

NPL Joins EPA’s SmartWay Transport Partnership

In September 2023, NPL was proud to announce that we were approved as a SmartWay Partner.

Launched in 2004 by the EPA, SmartWay provides a system that tracks, documents, and shares information about fuel use and freight emissions across supply chains. This helps companies identify more efficient methods and modes to improve their supply chain.

By being a SmartWay Partner, we can help companies reduce freight-related emissions and increase efficiency by accelerating the use of advanced fuel-saving technologies.

NPL will also contribute to the Partnership’s savings of 379 million barrels of oil, $52 billion on fuel costs, 162 million metric tons of CO2, 2.8 million short tons of NOx, and 114,000 short tons of PM. This is the equivalent to eliminating annual energy use in over 24 million homes!

As a company, we believe environmental stewardship is a crucial aspect of the supply chain and it’s important that we do our part to promote practices that help mitigate pollution and reduce the use of resources.

That’s why NPL is excited to share our participation in the SmartWay program and contribution to a more sustainable future for all!

For more information about the SmartWay Transport Partnership visit www.epa.gov/smartway

Port of Los Angeles January Import Surge

The Port of Los Angeles saw significant growth in import volumes during January, marking its second-best January on record. Total TEUs handled during the month experienced an 18% increase compared to the previous year, although the growth compared to pre-COVID levels was minimal. Loaded imports reached a record high, up 19% year over year, reflecting strong consumer spending and inventory replenishment efforts ahead of the Lunar New Year holiday. Gene Seroka, the port’s executive director, credited these factors for driving import growth during a media briefing.

Despite challenges like the situation in the Panama Canal, which saw increased scheduled slots but no corresponding increase in transits, the Port of Los Angeles experienced robust performance. Loaded export volumes also surged, reaching the highest levels since November 2020, with a notable 23% year-over-year increase in January. This growth was supported by strong inbound loaded international intermodal container volumes, which are expected to continue boosting export volumes in the coming months.

Looking ahead, the pull-ahead effect for the Lunar New Year is anticipated to sustain import volumes into February and possibly March. The impending labor negotiations between the International Longshoremen’s Association union and the East Coast ports could further bolster the Port of Los Angeles, positioning it favorably in the U.S. freight economy.

US Warehouse Rates Likely to Continue Their Rise

In 2023, U.S. warehouse and distribution space rents surged to a record $9.72 per square foot, marking a significant 20.6% year-over-year increase, according to Colliers. Rent increases are projected to persist, albeit at a more restrained pace, owing to historically low vacancy rates. While major markets such as New York City, the San Francisco Bay area, and Chicago experienced rent hikes, rates declined in areas like greater Los Angeles, Philadelphia, and Detroit.

Despite the surge in new industrial real estate supply, rental rates are expected to stabilize due to a dwindling construction pipeline and escalating costs. Prologis, a global logistics real estate firm, anticipates modestly positive rent growth aligned with inflation over the next year. However, the pace of growth decelerated in the latter half of 2023, with markets like greater Los Angeles and the New York City metro area witnessing increased available space and rising vacancy rates. This stabilization in demand, coupled with increased inventory availability, contributed to the rise in vacancy rates.