February 23rd, 2024

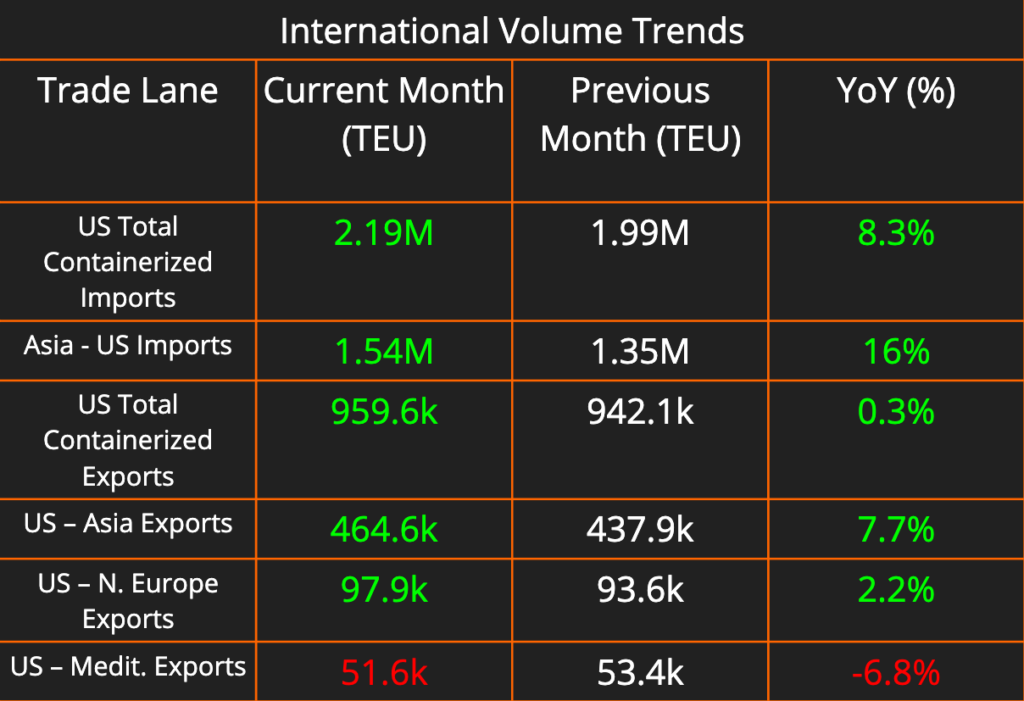

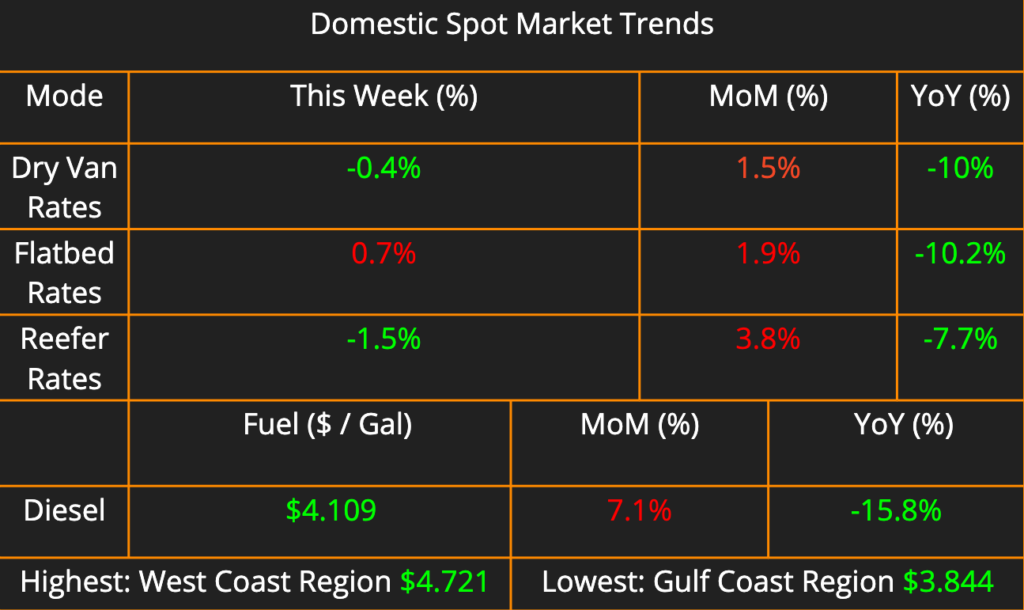

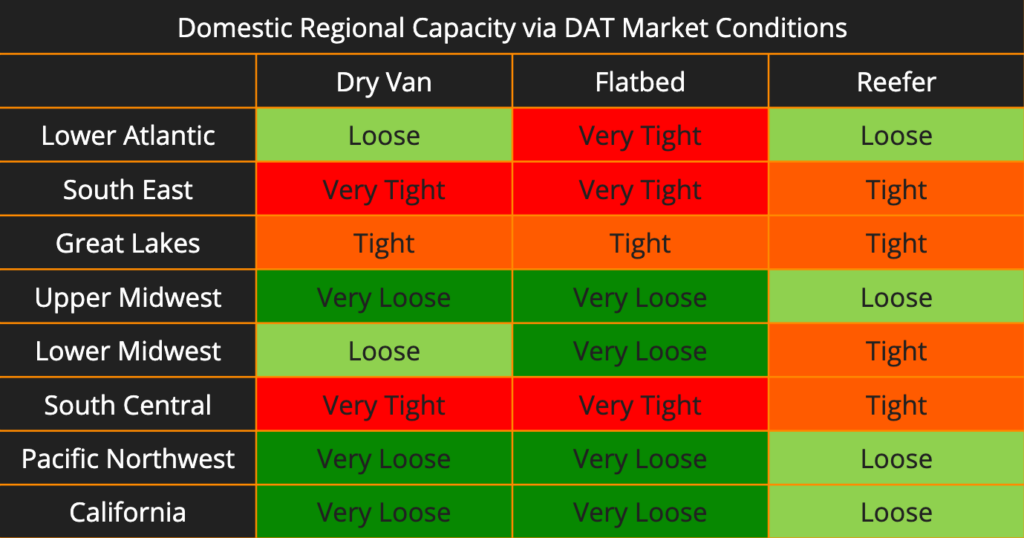

In this week’s newsletter we updated the trends we’re seeing in international volumes, the domestic spot market, and the domestic capacity market (please download external images to view).

Also, the EU’s 2024 ETS rollout will have an impact on shipper’s costs. And Norfolk Southern announces a halt to Midwest services through the Ports of Savannah and Charleston.

Overall, not many changes from last week’s chart. Flatbed capacity remains the exact same with half the regions showing either Very Tight / Tight Capacity and the other regions showing Very Loose capacity. The two main changes are in Dry Van and Reefer. Dry van capacity in the South Central has changed from Tight to Very Tight. Reefer capacity in the Pacific Northwest has changed from Tight to Loose. Additionally, reefer capacity in the Lower Atlantic has upgraded to Loose from Very Loose.

Anticipating the Financial Impacts of EU Emissions Trading System (ETS) on Shippers in 2025

Asia-based ocean carriers are facing a substantial bill of €500 million ($540 million) in 2024 for complying with the European Union Emissions Trading System (ETS), expected to rise to €1 billion once fully implemented. These costs, predicted by OceanScore, will be passed on to shippers through surcharges by the end of the first quarter of 2024. The ETS mandates the surrender of EU Allowances (EUAs) by carriers for voyages to and from the EU, aiming to reduce emissions and incentivize greener alternatives.

OceanScore’s projections rely on anticipated EUA surrender volumes by Asian shipowners from 2026, factoring in the current carbon price volatility, hovering at approximately €55 per ton of CO2. The ETS is geared towards incrementally heightening costs to drive a transition away from fossil fuels, placing a progressively larger share of ship emissions responsibility on carriers, slated to peak at 100% by 2026. These regulatory strides resonate with broader global targets outlined by the International Maritime Organization (IMO), aiming for substantial emissions reductions by 2030, 2040, and ultimately achieving full decarbonization by 2050. As Europe spearheads emissions reduction initiatives, it sets a precedent likely to influence other regions, while the burgeoning adoption of greener fuel vessels signals an imminent global shift towards sustainability in maritime transport, foreshadowing the potential expansion of surcharges to encompass global trade routes.

Norfolk Southern Ceases Intermodal Service from Charleston and Savannah to Midwest Cities Amid Low Volumes

Norfolk Southern Railway will cease intermodal service from the ports of Charleston and Savannah to destinations including Chicago, Cincinnati, and Louisville in mid-March due to low volumes. The decision was prompted by underperforming routes, with only around 1,000 import containers to Chicago and Cincinnati, and 2,500 to 3,000 to Louisville last year. Georgia port officials had aimed to promote the “Mid-America Arc,” but Norfolk Southern’s move deals a setback. Meanwhile, NS plans to redirect resources to high-volume lanes like Atlanta and Memphis, responding to a surge in import volumes in those areas. This strategic shift reflects NS’s aim to prioritize growing routes and ensure resource optimization.