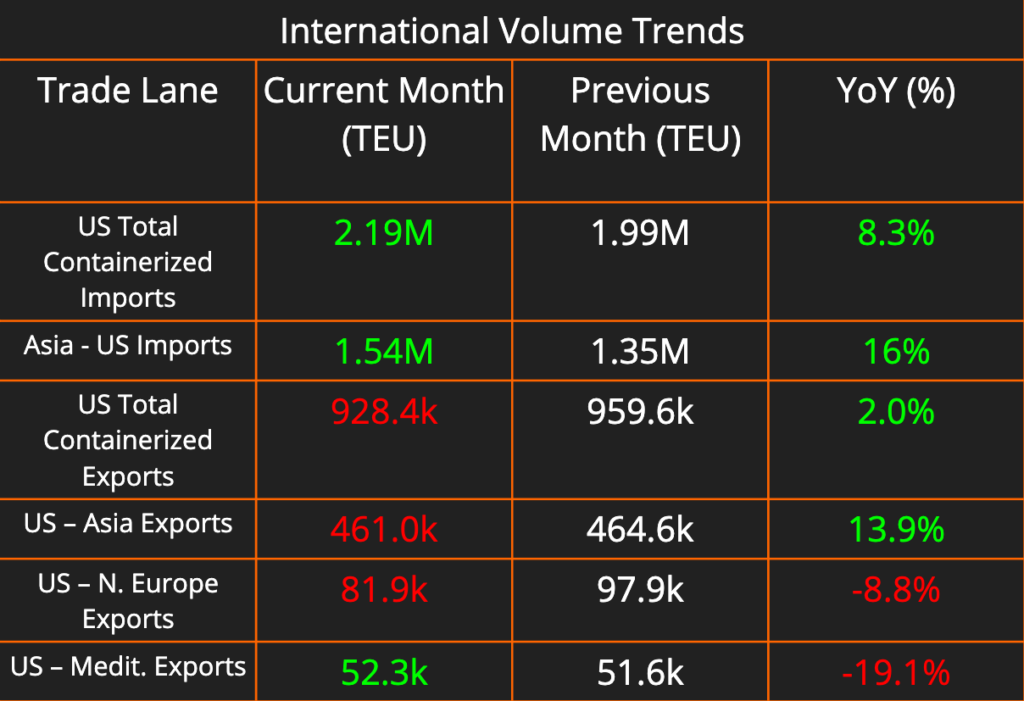

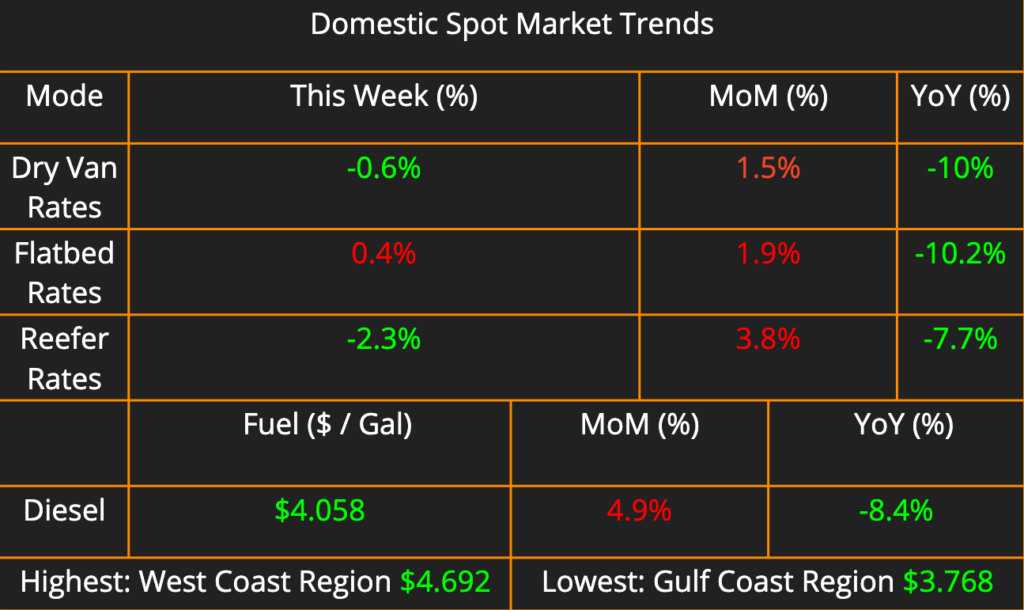

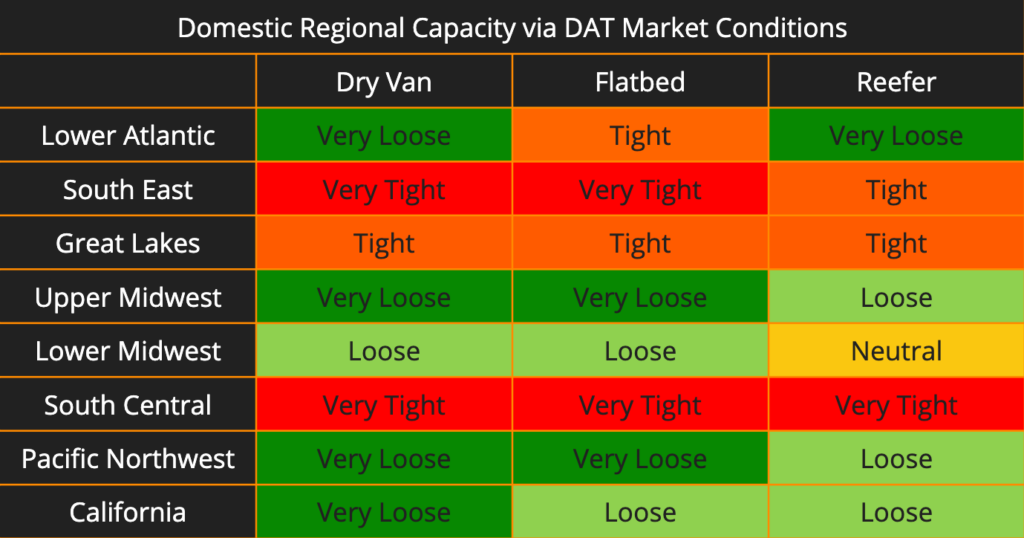

In this week’s newsletter we updated the trends we’re seeing in international volumes, the domestic spot market, and the domestic capacity market (please download external images to view).

Also, the extension of the Ocean Alliance and formation of Gemini alliance. We also discuss the new FMC ruling on demurrage and detention billing practices.

The biggest trend we are seeing is the South-Central region, which is marked as very tight across the board. The tightening of conditions in Dry Van and Reefer freight is likely due to imports of seasonal produce from Mexico. Mid-February to March kicks off produce imports from hotter climates to the U.S., this also signals that produce season will begin domestically within the next few weeks. Look for capacity in Florida to tighten first, followed by the deep South and gradually the Midwest and California in Mid-March / Early April.

Ocean Alliance extension and Gemini Alliance reshape Global Logistics

In a significant development within the global logistics arena, four major container lines from Asia and Europe have agreed to extend their vessel-sharing agreement until 2032. China’s Cosco Shipping, France’s CMA CGM, Taiwan’s Evergreen Marine, and Hong Kong-based Orient Overseas Container Line, a unit of Cosco, have opted to prolong their collaboration under the Ocean Alliance pact, initially formed in 2017. This agreement, which was due to expire in 2027, aims to address the challenges posed by a market characterized by ample capacity and depressed freight rates. Alliances such as these allow carriers to offer broader geographic coverage while reducing costs.

In January, Maersk and Germany’s Hapag-Lloyd announced the formation of a new alliance called Gemini, bringing together the world’s second and fifth-largest container lines by capacity. The collaboration, involving around 290 vessels with a combined capacity of 3.4 million containers, represents a significant realignment in the industry. As part of this shift, Hapag-Lloyd will depart from THE Alliance, which includes South Korea’s HMM, Singapore’s Ocean Network Express, and Taiwan’s Yang Ming, by 2025.

These realignments occur amidst declining ocean carrier earnings following historic highs during the Covid-19 pandemic. Maersk reported a loss in shipping operations in its fiscal fourth quarter, projecting lower underlying earnings for the year compared to previous years. Similarly, CMA CGM reported losses for the fourth quarter, with revenue declining due to tumbling freight rates. Furthermore, recent attacks on merchant vessels in the Red Sea have compelled shipping lines to divert their vessels, leading to increased fuel costs and higher freight rates, adding complexity to an already challenging market environment.

FMC Introduces New Rule Addressing Detention and Demurrage Billing Practices

The Federal Maritime Commission (FMC) has introduced a new rule addressing detention and demurrage billing practices, aligning with the Ocean Shipping Reform Act of 2022. These practices posed significant challenges for shippers, with ocean carriers reportedly collecting nearly $7 billion in related costs between 2020 and 2022. The FMC’s final rule, released on Feb. 23, highlights key regulations aimed at clarifying invoicing procedures and timelines.

One crucial aspect outlined by the FMC is the specification of who is eligible to receive invoices. Invoices for detention or demurrage can be issued to either the entity for whom services were provided or the contracting party. Alternatively, they can be directed to the consignee, the ultimate recipient of the cargo. However, the rule prohibits issuing invoices to both parties mentioned in the first scenario and the consignee, nor to any other person.

Moreover, the final rule establishes a 30-calendar-day timeframe for issuing detention and demurrage invoices, with billed parties granted 30 days to request fee mitigation, refunds, or waivers. If requested within the stipulated timeframe, billing parties must aim to resolve the matter within an additional 30 days, unless an extended timeframe is mutually agreed upon.

Most provisions of the ruling are set to take effect on May 26, with the exception of Section 541.6, pending further approval as the FMC seeks additional information. By emphasizing a clear link between cargo pick-up delays or equipment return issues and supply chain fluidity, the FMC aims to streamline operations and mitigate disruptions in the global logistics landscape. Clients are encouraged to connect with their NPL account manager with any questions regarding the new regulations.