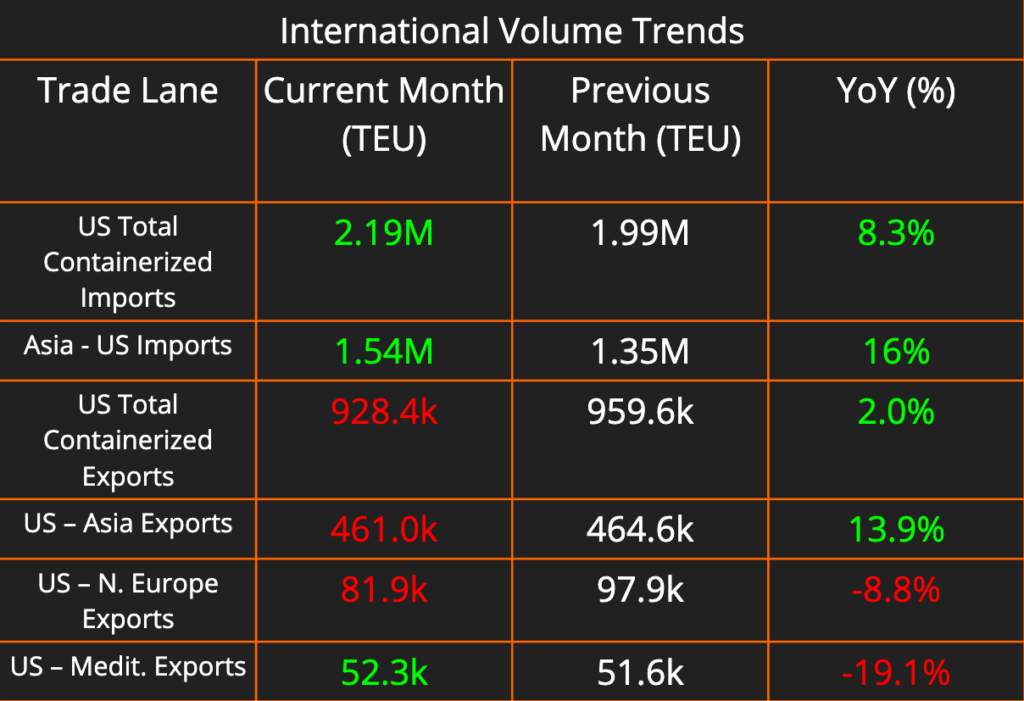

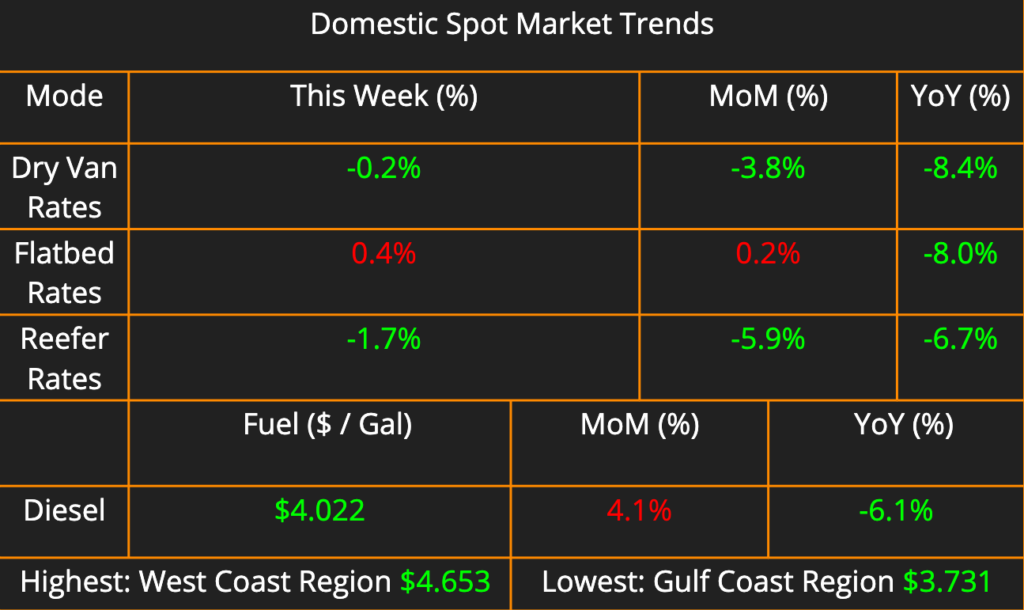

This week’s newsletter brings you a comprehensive look at the shipping and logistics landscape. We’ll analyze the latest data on containerized imports and exports, focusing on key US trade lanes. For domestic shipping, we’ll explore current rates and trends for dry van, flatbed, and reefer freight, along with regional capacity variations.

We’ll also examine a global trade concern: the recent Houthi missile attack in the Red Sea and its potential disruption to international supply chains. Finally, we’ll delve into the LTL industry’s “land rush” as carriers scramble to secure land and expand their networks to meet surging demand.

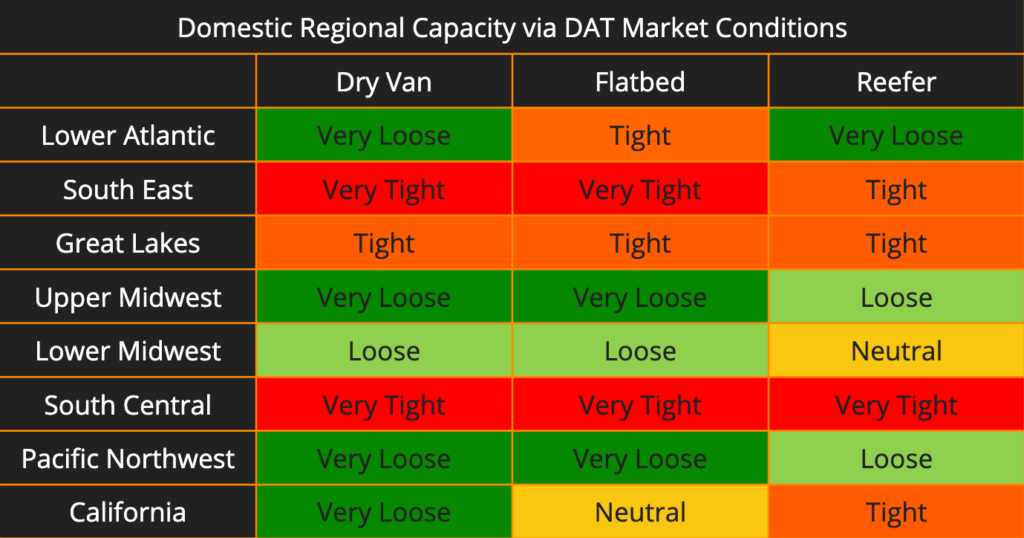

Overall, we’re still seeing South Central remain very tight as produce imports from Mexico flood the region and the carriers have their pick of loads. There is a lot of demand to get to these border regions right now, especially for refrigerated freight. Another notable change from last week is that California is starting to tighten up across all modes. Refrigerated capacity jumped from Loose to Tight, Flatbed Capacity jumped from Loose to Neutral, and Dry Van capacity Jumped from Very Loose to Loose.

Houthi Missile Attack in Red Sea Leaves Three Dead, Threatens Global Trade Flow

A missile attack by Yemen’s Houthi rebels on a commercial ship in the Red Sea has resulted in the first civilian casualties of their campaign against the crucial shipping route. Three crew members were killed and several others injured when the Houthi missile struck the Barbados-flagged, Greek-operated “True Confidence” on Wednesday.

An Indian warship heroically rescued all 20 remaining crew members from the burning vessel and transported them to a hospital in Djibouti. The attack has sparked outrage in the international shipping community, with leading organizations condemning the violence and calling for increased protection for seafarers traversing the Red Sea.

This incident marks a grim escalation in the Houthis’ campaign of attacks on commercial vessels, which they claim are acts of solidarity with Palestinians during the recent Israel-Hamas conflict. However, the human cost of these attacks is becoming increasingly apparent.

The International Transport Workers’ Federation (ITF), a major seafarers’ union, urged the industry to prioritize crew safety. “No delivery window is worth the loss of seafarers’ lives,” declared ITF General Secretary Stephen Cotton. The union proposed diverting ships around Africa’s Cape of Good Hope until the Red Sea can be guaranteed safe for transit.

However, rerouting comes at a hefty economic price. Insurance costs for Red Sea voyages have skyrocketed in recent months. This latest attack could push companies to permanently adopt the longer Cape of Good Hope route, significantly disrupting global supply chains. Such a shift would add roughly ten days to journeys, causing delays for businesses and potentially driving up consumer costs.

Land Rush Grips LTL Carriers as They Scramble to Meet Shipper Demands

The Less-Than-Truckload (LTL) shipping industry is experiencing a land rush. Securing land for new terminals has become a top priority for carriers in 2024. This urgency is driven by a confluence of factors, including:

- Increased Demand: The LTL market is experiencing a boom, driven by the rise in omnichannel retail and the increasing network optimization of shippers. To meet this rising demand, carriers need more space for sorting, processing, and storing freight.

- Yellow’s Exit: The recent bankruptcy and exit of major LTL player Yellow Freight has freed up valuable real estate, creating a prime opportunity for expansion-minded carriers. Over 9,000 dock doors from Yellow’s former facilities are now up for auction, with companies like Estes Express Lines, XPO, and Saia Motor Freight already acquiring significant portions.

Carriers are adapting their land acquisition strategies to better serve their customers through:

- Network Reconfiguration: The focus isn’t just on building new terminals, but also strategically locating them to optimize existing networks. This allows for improved route planning and reduced transit times.

- Automation Integration: New terminals are being designed to incorporate automation technologies like conveyor systems and sorting robots. This will enhance efficiency and potentially reduce labor costs. (Source: [invalid URL removed])

The land rush has positive implications for shippers:

- Expanded Network Coverage: With additional terminals and a wider geographic reach, shippers can expect access to LTL services in areas previously underserved.

- Competitive Rates: As carriers increase their capacity through expansion, they may be more inclined to offer competitive rates to attract new business and fill the additional space.

Overall, the land acquisition trend in the LTL sector is driven by a need to keep pace with evolving customer demands and capitalize on new opportunities. This shift is likely to benefit shippers through improved service options, potentially lower costs, and a more robust LTL network.