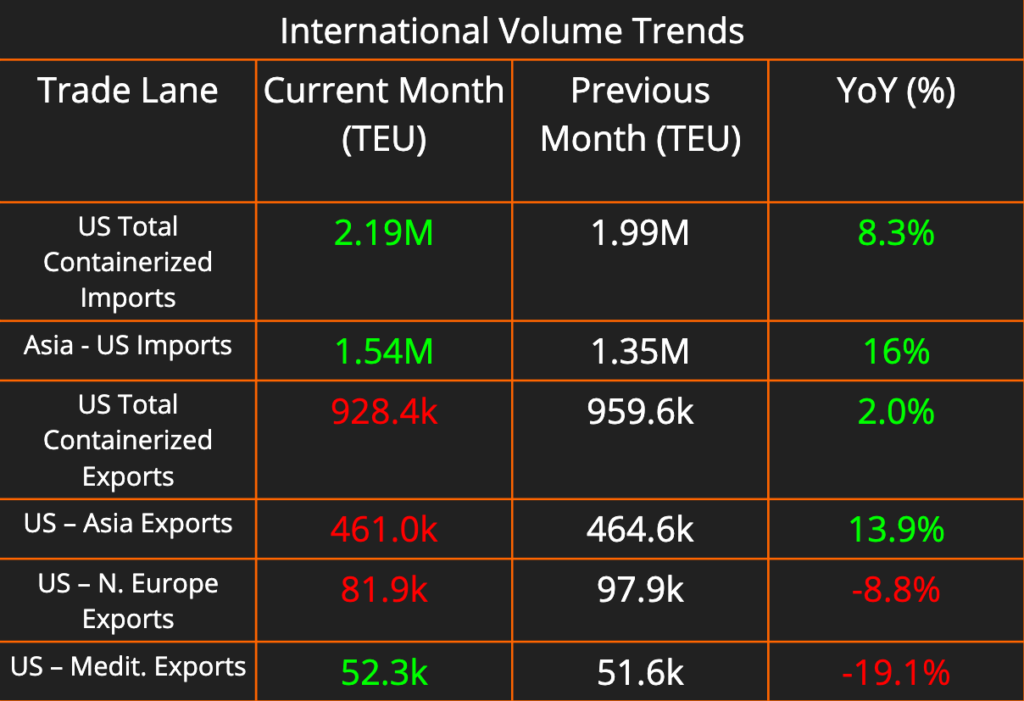

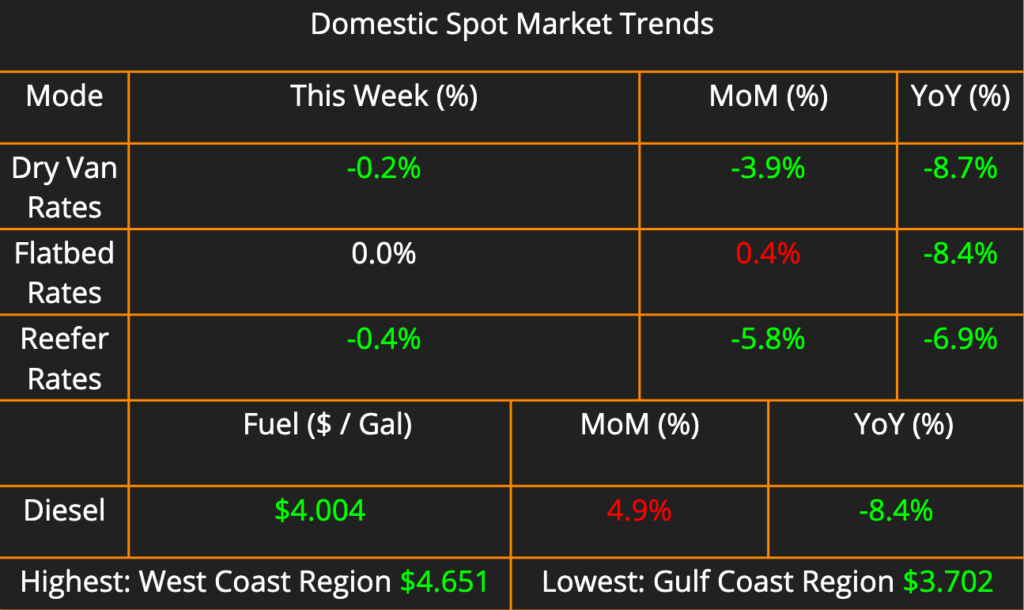

This week’s newsletter brings you a comprehensive look at the shipping and logistics landscape. We’ll analyze the latest data on containerized imports and exports, focusing on key US trade lanes. For domestic shipping, we’ll explore current rates and trends for dry van, flatbed, and reefer freight, along with regional capacity variations.

We’ll also examine new investments into a major East Coast roll-on, roll-off port. As well as the Biden Administration’s new plan, the National Zero-Emission Freight Corridor Strategy, for tackling decarbonization in freight.

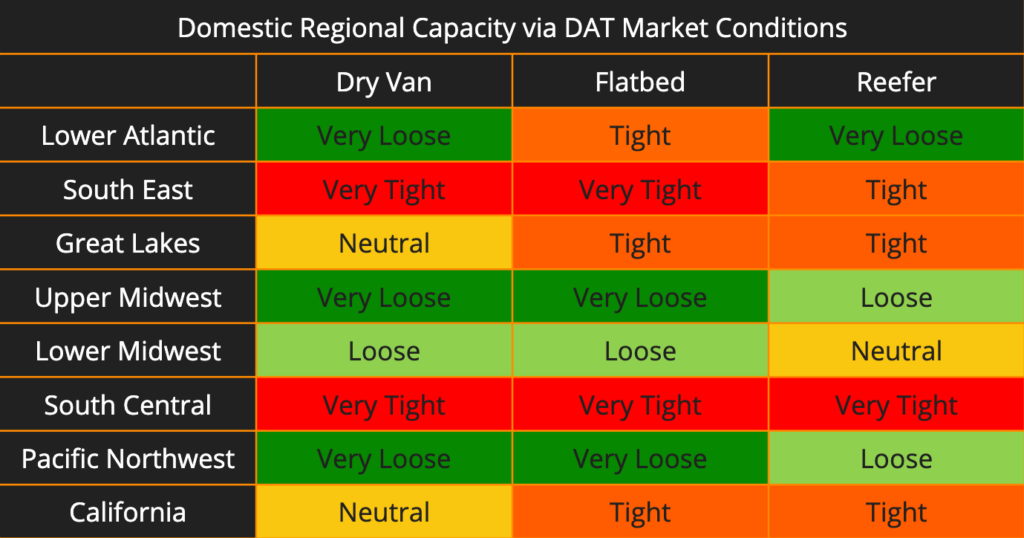

Overall, we are not seeing much change week over week. We see California tightening up across the board with Dry van going from Loose to Neutral and Flatbed going from Neutral to Tight. The South Central still remains very tight across all modes as produce season starts to ramp up. One significant change is that the Great Lakes region downgraded from Tight to Neutral for Dry Van capacity, which marks the first change in a region that has been consistently tight for the past few weeks.

Brunswick Boosts Capacity: $277 Million Investment Planned for Major Auto Port

The Port of Brunswick, a major auto import hub located between the ports of Savannah and Jacksonville, is set to receive a $17.45 million upgrade to its harbor facilities. Along with more than $260 million investment in Brunswick’s warehousing infrastructure.

The U.S. Army Corps of Engineers recommended the project, which includes a bend widener, an expansion of the turning basin, and a larger meeting area at St. Simons Sound. In 2023, the port handled a record number of shipments, an increase of 15.6% over the previous year. These improvements are expected to enable the port to accommodate larger ships, leading to greater efficiency and potentially lower costs for international shippers. The project is expected to take roughly a decade to complete.

The Port of Brunswick’s status as a major auto import facility makes this development particularly significant for shippers in the auto industry, however signals a broader trend of East Coast states increasing investments in coastal ports in order to compete for U.S. manufacturing shipments.

U.S. Unveils Ambitious Strategy for Zero-Emission Freight Transport

The Biden administration has announced an ambitious plan aimed at revolutionizing freight transportation in the United States through the deployment of zero-emission charging capabilities. The strategy, known as the National Zero-Emission Freight Corridor Strategy, focuses on deploying battery-charging and hydrogen-refueling stations for electric trucks along 12,000 miles of freight-heavy interstates and major container ports over a 16-year period. Initially targeting local and regional trucking operations and port drayage, the plan gradually expands to accommodate long-haul trucking, aligning with the administration’s ambitious goals of achieving net-zero emissions for the nation by 2050.

Developed by the U.S. departments of Energy and Transportation and the Environmental Protection Agency, the strategy “is to meet freight truck and technology markets where they are today, determine where they are likely to develop next, and set an ambitious pathway that mobilizes actions to achieve decarbonization,” according to the Federal Highway Administration. It includes four phases aimed at accelerating the adoption of battery-electric and fuel-cell electric trucks, starting with priority hubs based on freight volumes and expanding to establish a comprehensive national network by linking regional corridors.

In conjunction with the charging strategy, the Federal Highway Administration (FHWA) has designated the National Highway Freight Network and roadways in several states as the National EV Freight Corridors network. This initiative supports the administration’s goal of promoting at least 30% zero-emission medium- and heavy-duty truck sales by 2030 and 100% by 2040.

The strategy’s phased approach targets specific interstate routes and major container ports, gradually expanding to include regional goods distribution and long-haul transportation. It aims to transition from battery-electric to hydrogen fuel cell electric truck technology and ultimately ensure full access to a national network of zero-emission freight corridors. With a focus on intermodal hubs, port facilities, and truck parking facilities, the plan underscores a concerted effort to enable the private-sector transition towards zero-emission transportation through public infrastructure investment.