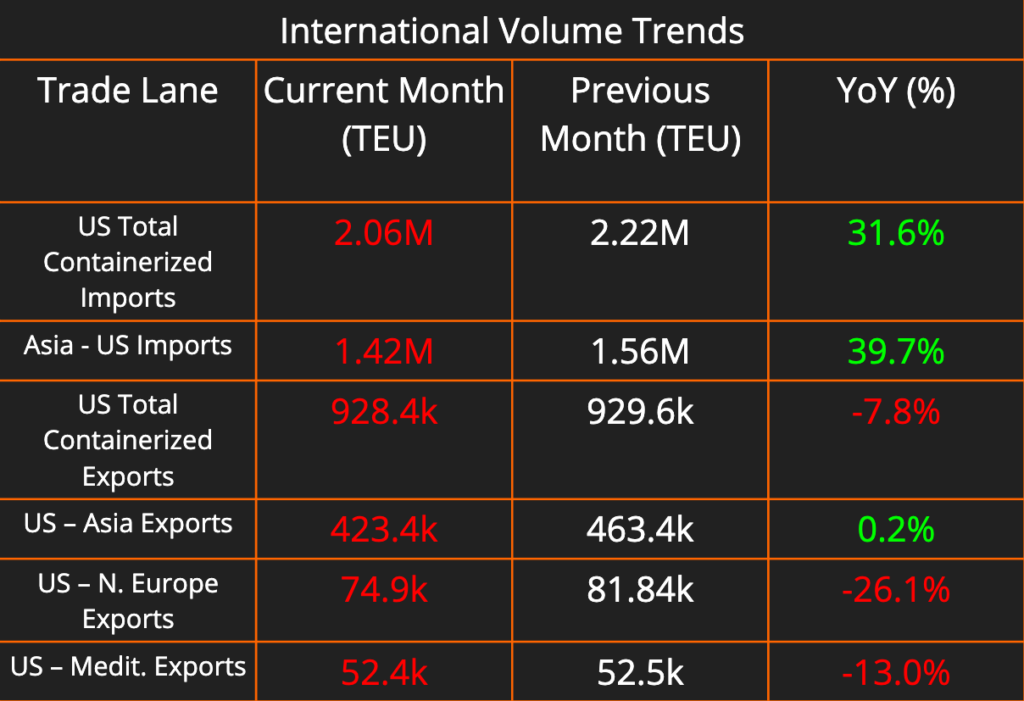

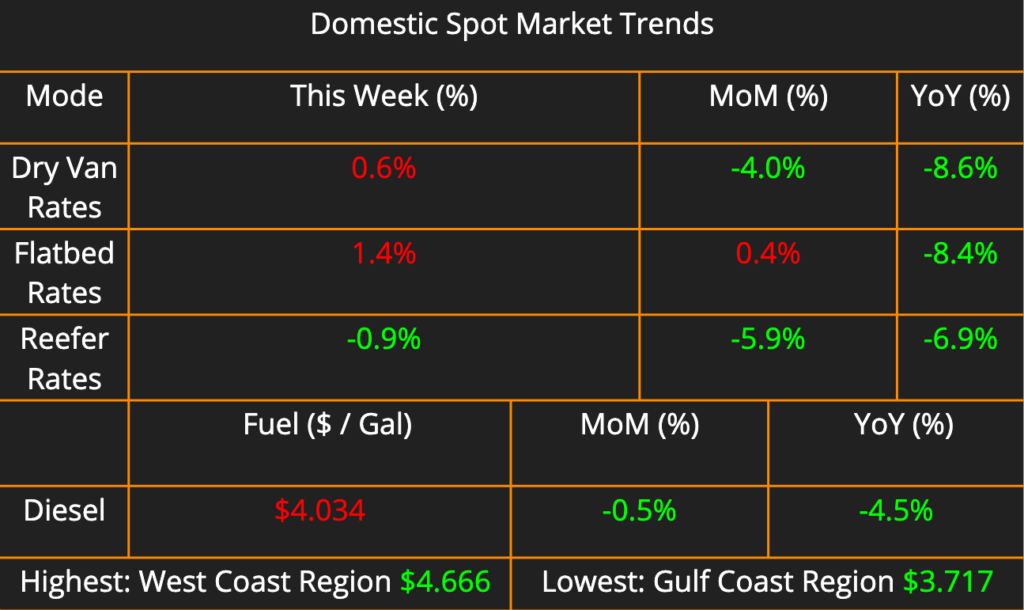

This week’s newsletter brings you a comprehensive look at the shipping and logistics landscape. The latest data on containerized imports and exports shows an overall decline in US international trade activity. Domestic shipping saw a gradual increase in freight rates compared to last week, but they remain nearly 10% lower than rates at this time last year.

We’ll also outline the impact and recovery timeline for the recent crash and collapse of the Francis Scott Key Bridge in Baltimore. As well as the future of California’s proposed AB5 legislation, which seeks to regulate independent contractors in the state.

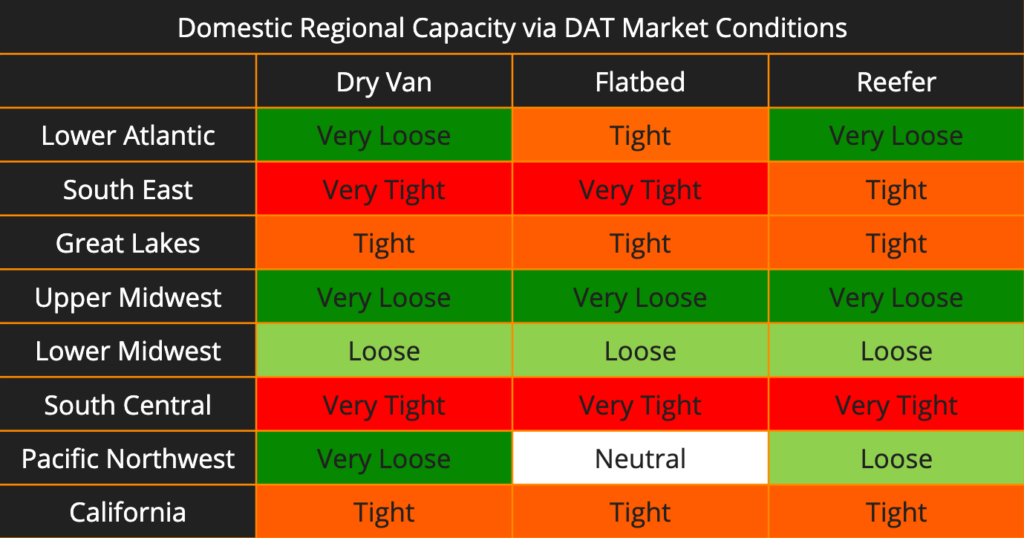

The transportation market continues to see regional variations in capacity. California’s dry van market, which remained neutral last week, has now tightened, joining flatbed and reefer markets in the state. Conversely, all transportation modes across the Midwest, both upper and lower regions, continue to exhibit loose or very loose capacity. The Great Lakes region (Wisconsin, Michigan, Chicago) presents an interesting contrast. Previously neutral in two out of three modes, capacity has now tightened across all three. Finally, South Central and Southeast regions remain tight to very tight, and are expected to stay that way for the next few months due to the ongoing produce season.

Francis Scott Key Bridge Collapse Cripples Baltimore, Disrupts Global Supply Chain

The devastating collapse of the Francis Scott Key Bridge in Baltimore this week has sent shockwaves through the global logistics industry. The bridge, a critical artery for freight movement between the Port of Baltimore and the East Coast highway system, is now impassable. This disruption threatens to delay deliveries, increase transportation costs, and exacerbate existing supply chain bottlenecks.

The Port of Baltimore is the nation’s third-busiest seaport for cargo tonnage. Annually, it handles goods valued at nearly $28 billion destined for points across the East Coast and Midwest. With the bridge out of commission, trucks carrying these goods must be rerouted, adding significant miles and hours to their journeys. The American Trucking Association estimates these detours will cost shippers billions and potentially lead to price hikes for consumers.

The long-term impact and timeline for recovery remain unclear. Immediate efforts focus on search and rescue for those missing after the bridge collapse. Engineers must then assess the damage and determine the feasibility of repairs versus rebuilding the bridge entirely. Experts warn that a full recovery could take months or even years, significantly impacting global logistics in the meantime.

The Baltimore bridge collapse serves as a stark reminder of the interconnectedness of the global economy and the vulnerability of critical infrastructure. As efforts to recover and rebuild get underway, businesses and consumers alike will be closely watching developments in Baltimore, bracing for potential delays and price fluctuations in the coming months.

California’s AB5: A Cloud of Uncertainty Hangs Over Owner-Operators

California’s Assembly Bill 5, or AB5, continues to be a source of controversy, particularly for the trucking industry and its independent owner-operators. The law, aimed at reclassifying gig workers as employees, has faced legal challenges due to its impact on these independent contractors. While a recent Supreme Court decision not to review the case appeared to be a blow to AB5’s detractors, the future of the law remains far from certain.

The primary concern for owner-operators is the potential loss of their independence. AB5 establishes a strict “ABC test” that companies must use to classify workers as independent contractors. Meeting all three prongs of the test – workers being free from control, performing work outside the usual course of business, and having an established independent business – is difficult for many owner-operator arrangements. If classified as employees, owner-operators would lose control over their work schedules and routes, and trucking companies would be responsible for benefits and taxes, potentially making the model financially unsustainable.

The legal battles surrounding AB5 are far from over. Industry groups are exploring further legal challenges, while some California lawmakers are proposing modifications to the law that would create exemptions for specific professions, potentially including trucking owner-operators. Additionally, the potential impact of a federal law addressing independent contractor classification remains to be seen.

The ultimate fate of AB5 will have significant ramifications for owner-operators in California. Whether the law stands as is, is modified, or faces a complete overhaul, the coming months will likely see continued legal wrangling and legislative activity that will determine the future of independent trucking in the state.