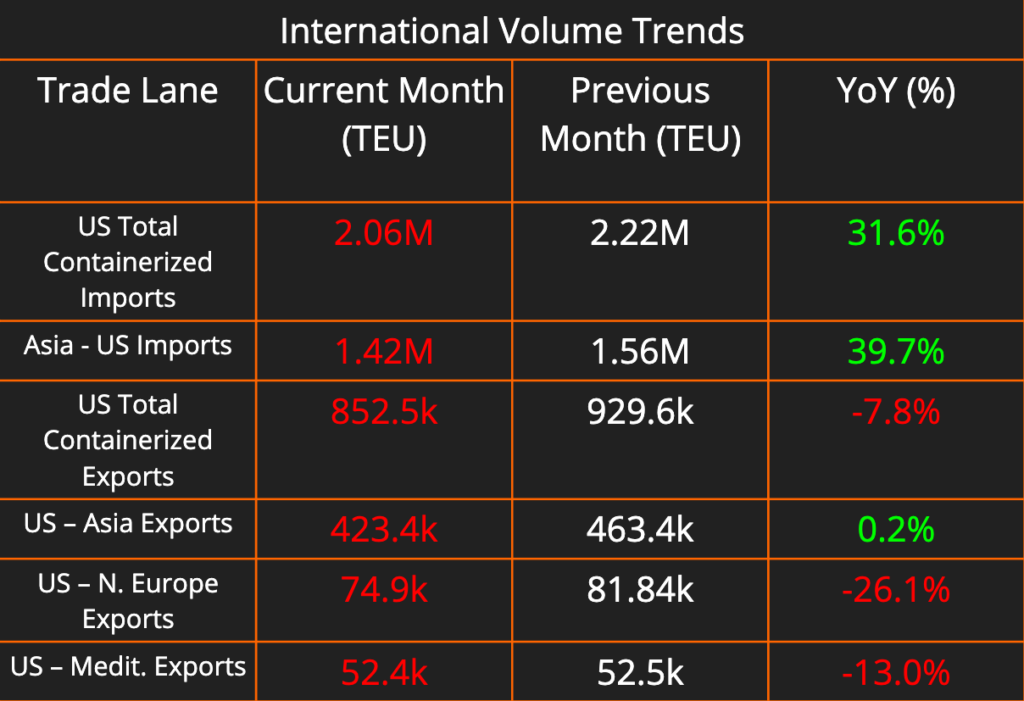

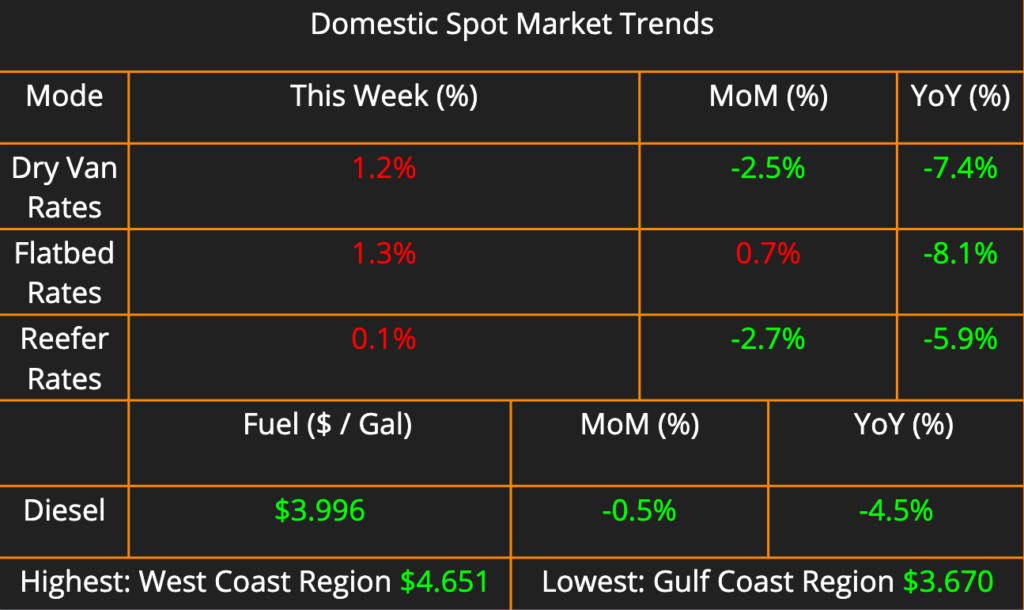

This week’s newsletter brings you a comprehensive look at the shipping and logistics landscape. The latest data on containerized imports and exports shows an overall decline in US international trade activity. Domestic shipping saw an increase in freight rates of all kinds compared to last week, however fuel rates decreased in every region.

We’ll also review the most recent Logistics Manager Index report, and what their findings say about the current logistics market. Finally we discuss the new parcel surcharges being instated by FedEx and UPS in major urban geographies across the US.

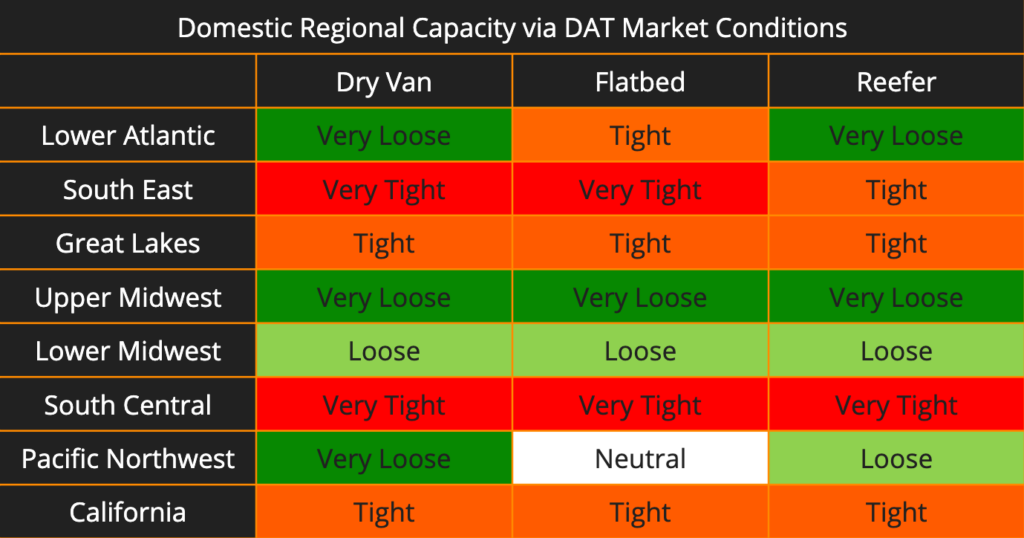

For the first time in our reporting, capacity has not changed at all from week to week. Each region Following the same trends as last week, the Great Lakes, Southeast, South Central and California regions remain red-hot, highlighting the demand for loads going to those regions from a carrier perspective.

The latest Logistics Managers’ Index (LMI) report for March 2024 offers a glimpse into the current state of the supply chain. Overall, the report paints a picture of a generally healthy industry, experiencing growth in key areas and a potential slowdown of the recent freight recession. However, it also highlights some trends that businesses should be aware of, particularly when it comes to consumer demand, warehousing, and transportation costs and capacity.

The March LMI Report: Navigating the Evolving Supply Chain Landscape

Rising Consumer Demand Fuels Inventory Growth

According to the LMI report, the index score for inventory levels sits at 63.8, the highest level since October 2022. This indicates a significant increase in consumer spending, which is likely to translate to higher inventory levels throughout the supply chain. Businesses should be prepared for the possibility of needing to store and ship more goods in the coming months.

Warehousing Concerns on the Horizon

The LMI report highlights a potential challenge for businesses, particularly smaller ones. Warehousing prices are on the rise, and with a tightening of warehouse capacity (contracting by 8.2% in March), securing appropriate storage space at a reasonable cost could become more difficult. Businesses may need to re-evaluate their storage needs and explore alternative solutions, such as public warehousing or fulfillment centers.

Transportation Costs Up, Capacity Remains

The LMI report indicates rising transportation costs, mirroring the trend we’ve seen in recent months. However, a key takeaway is that transportation capacity remains relatively high. The LMI reading for transportation capacity sits at 58.1, which while not at its peak, suggests there is still sufficient availability of trucks and other transportation options to move goods. This means that while shipping costs might be higher, businesses shouldn’t face major disruptions due to a lack of transportation resources.

Understanding the LMI Index

The LMI is a composite index that reflects the overall health of the logistics industry in the United States. It is calculated using a diffusion index, where any reading above 50 indicates expansion and any reading below 50 signifies contraction. The LMI for March 2024 sits at 58.3, which is the fastest rate of expansion since September 2022 and suggests a healthy and growing logistics industry. While the overall index is positive, it’s important to note that the transportation specific index (55.8) is slightly lower, indicating a slower rate of growth in the transportation sector compared to other areas of logistics.

Delivery Area Surcharges Announced by FedEx, UPS

Effective April 2024, both FedEx and UPS will be implementing Delivery Area Surcharges (DAS) for deliveries in 82 zip codes across the United States. These zip codes, concentrated in major urban centers like Boston, Chicago, Los Angeles, and New York City, represent roughly 1% of the US population. The per-package surcharge ranges from $3.95 to $5.85, with potentially even higher costs for deliveries within those zip codes categorized as “extended” or “remote.”

This announcement reflects the increased operational challenges and costs associated with delivering in densely populated areas. Delivery surcharges are not a new concept, but these targeted increases highlight a potential trend for businesses to expect higher delivery costs in urban locations. For businesses shipping a high volume of parcels, these surcharges could potentially make a significant impact.