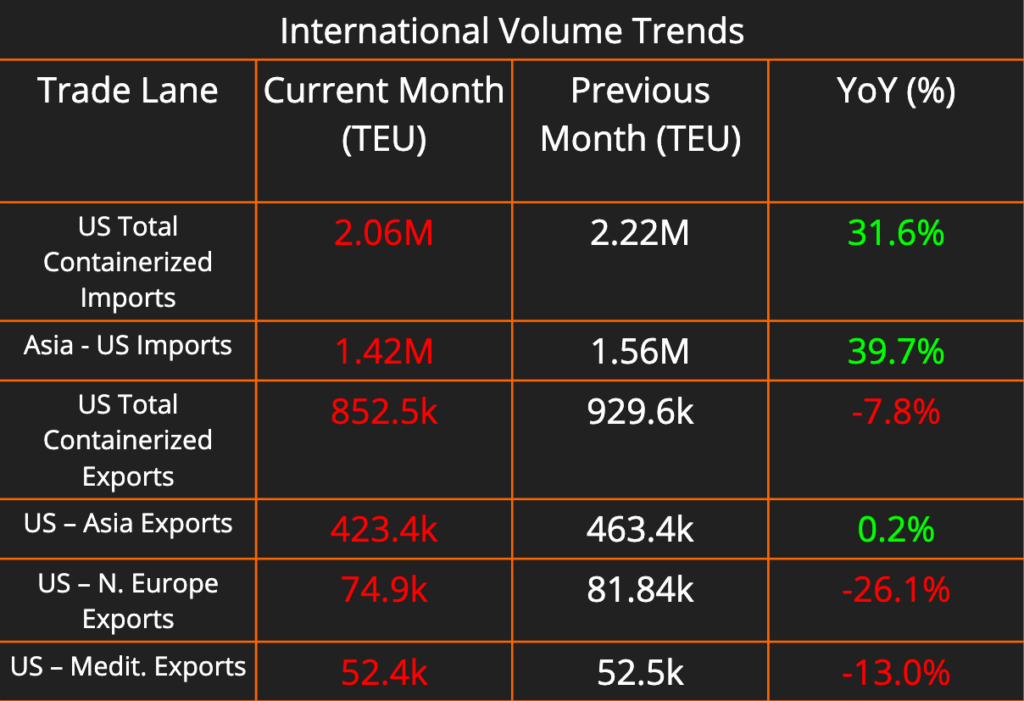

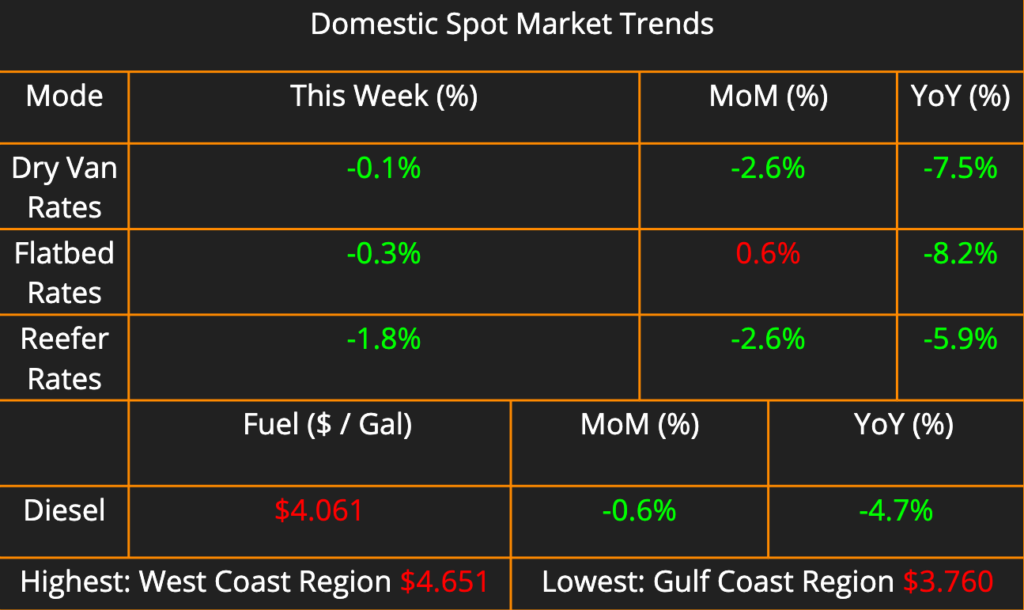

This week’s newsletter brings you a comprehensive look at the shipping and logistics landscape. The latest data on containerized imports and exports shows an overall decline in US international trade activity. Domestic shipping saw a slight decrease in freight rates of all kinds compared to last week, however fuel rates increased in every region.

We provided an update on the schedule of repairs to the Francis Scott Key Bridge and the Port of Baltimore. We discussed the recent decision of a major air carrier to send two brand new 767s straight into storage, and what that tells us about the air freight market. And finally, we provided a notice of the upcoming DOT Week from May 14th through the 16th.

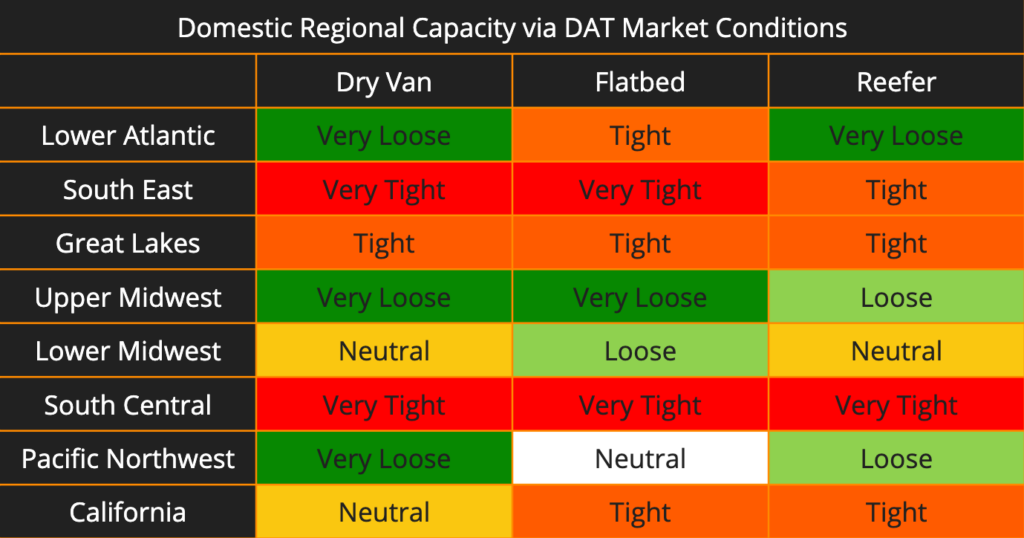

There are a few changes in the capacity matrix week to week. Dry van and Reefer capacity in the Lower Midwest shifted from Loose to Neutral. Overall, this is telling us that capacity in the Lower Midwest is beginning to tighten. Additionally Dry Van capacity in California has downgraded from Tight to Neutral. There are a few areas that have not shown any change for the past few weeks. That would be the Southeast, South Central and Great Lakes regions. They are all remaining Tight / Very Tight throughout the month.

Limited Access to Baltimore Port Expected to Resume by End of April

The U.S. Army Corps of Engineers (USACE) recently announced a tentative timeline for restoring safe navigation in and out of the port, following the collapse of the Francis Scott Key Bridge in early April 2024.

According to the USACE, a limited access channel is expected to be operational by the end of April. This temporary channel, measuring 280 feet wide and 35 feet deep, would allow for one-way traffic of barge container service and roll-on/roll-off vessels – ships that transport automobiles and farm equipment.

While full port access won’t be restored immediately, this development signifies a significant step towards normalcy for the Baltimore Port. The USACE also aims to reopen the permanent, 700-foot-wide and 50-foot-deep federal navigation channel by the end of May, allowing for full capacity operations to resume.

It’s important to note that the USACE emphasizes these are ambitious timelines and could be impacted by unforeseen circumstances like severe weather or complications during the wreckage removal process. However, this initial announcement provides a much-needed roadmap for businesses that rely on the Baltimore Port for their supply chains.

Soft Airfreight Market Grounds New Boeing 767 Freighters

The airfreight industry’s recovery appears to be hitting a snag, as evidenced by a recent report from FreightWaves. Northern Air Cargo and its affiliates made the surprising decision to send two brand new Boeing 767 freights directly into storage upon delivery, postponing their initial commercial flights. This comes despite a reported 12% YoY increase in cargo volumes during the first quarter of 2024

While analysts still predict annual growth of around 3.5% for the airfreight market in 2023, this news highlights the unevenness of the recovery. The strong global average is largely driven by major trade lanes out of Asia, according to the International Air Transport Association. North America, for example, experienced the weakest growth in February of any region.

This development underscores the current market dynamics for shippers involved in airfreight. Although some sectors, like e-commerce, remain robust, overall demand has softened. This can lead to fluctuations in pricing and potential capacity constraints on specific routes, even as the global market shows signs of improvement.

DOT Week 2024: May 14th-16th

We are approximately a month away from the annual Commercial Vehicle Safety Administration (CVSA) International Roadcheck, sometimes called “Blitz Week”. The 72-hour period of intensified truck inspections takes place May 14th-16th, 2024. In past years, law enforcement in the US, Mexico, and Canada has pulled over as many as 15 semi-trucks per minute during the event. This period may impact your ability to secure truck capacity and potentially raise freight costs.

Fewer Trucks on the Road: During the International Roadcheck period, we generally see a decrease in available trucks. While most carriers operate normally, some drivers may choose to take time off to avoid inspections. This decrease in supply, coupled with consistent demand for freight, could lead to tighter capacity and difficulty finding trucks for your shipments.

Expect Higher Rates: With potentially fewer trucks available and the same amount of freight needing to move, basic economics comes into play. Carriers may increase their rates during Blitz Week to compensate for the additional risk and potential delays caused by inspections.