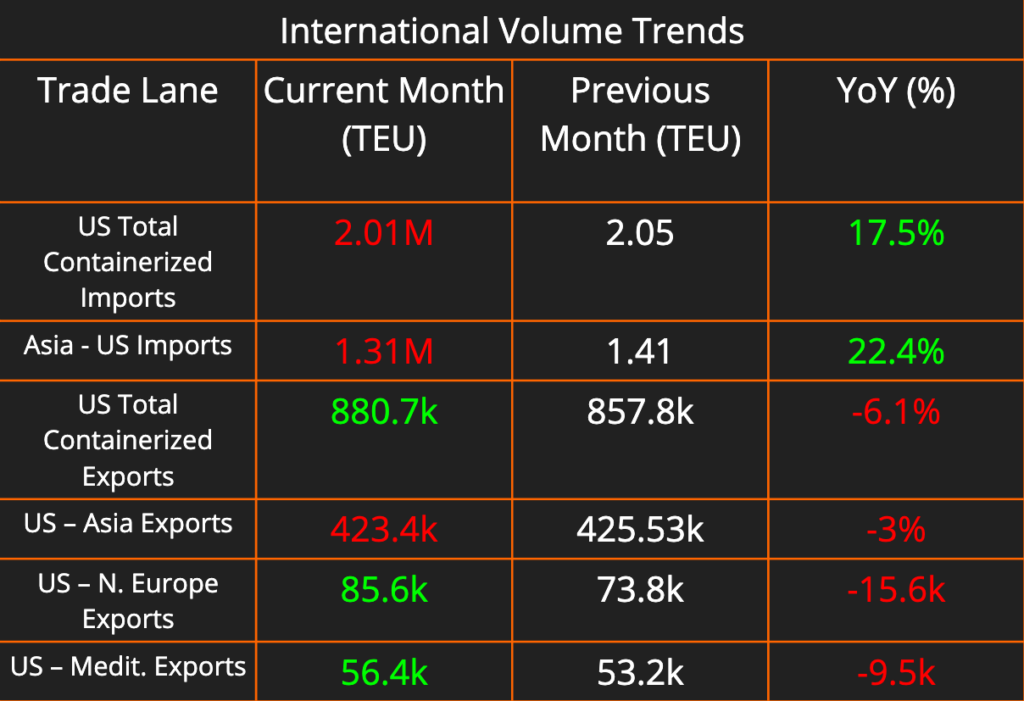

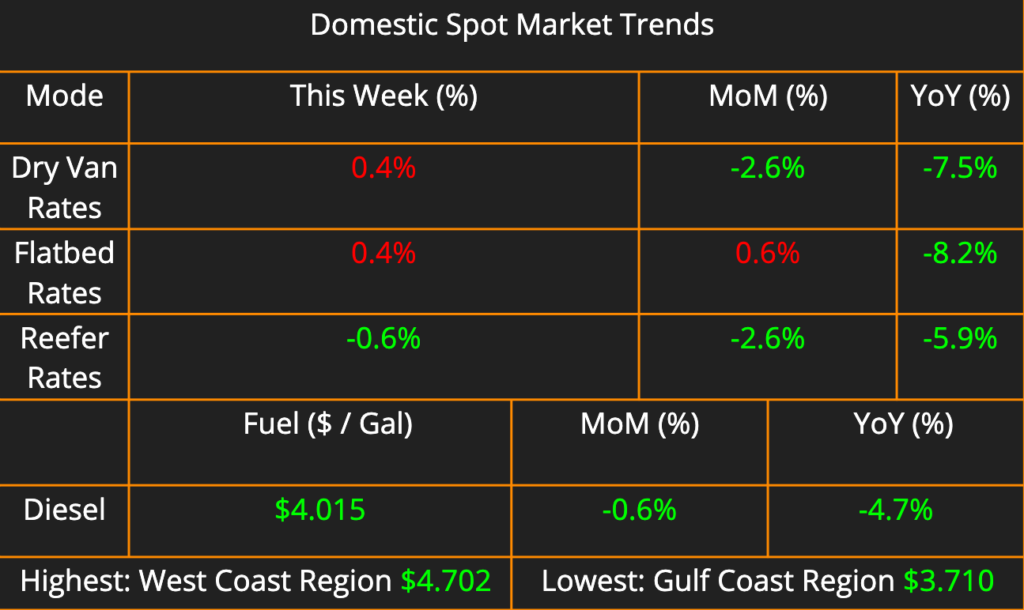

This week’s newsletter brings you a comprehensive look at the shipping and logistics landscape. The latest data on containerized imports and exports shows a general decline in US import activity and a month-over-month increase in US exports, driven by steady increases to Europe. Domestic shipping saw slight increases in dry freight rates and a decrease in refrigerated spot rates week-over-week. Fuel costs decreased in every market.

We provided an update on the declaration of a ‘general average’ by the owner of the ship that collided with the Francis Scott Key Bridge and explored the costs associated with a ‘general average’ event. Finally, we discussed the continued growth of US-Mexico trade along with some of the statistics in shipment volumes through US border crossings.

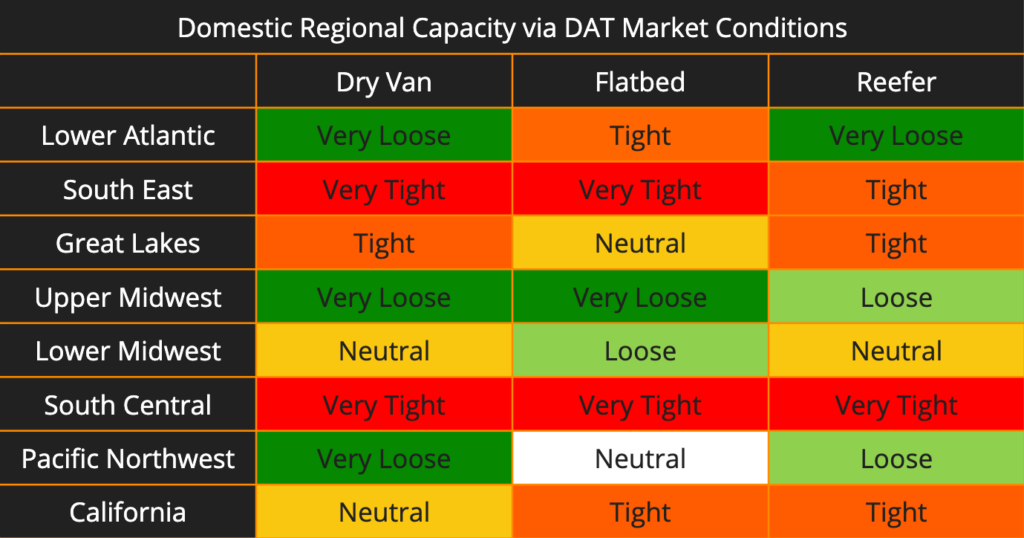

There are not many changes to our Domestic Regional Capacity tracker week-over-week. We are beginning to see flatbed capacity loosen in the Great Lakes region for the first time in two months. Capacity remains tight in the South Central and Southeast regions as construction ramps up and the demand to get dry and reefer loads out of those regions increases.

Baltimore Bridge Collapse Triggers General Average: What Shippers Should Know

The recent collapse of the Francis Scott Key bridge has caused significant disruption to the shipping industry, with another complication arising: the declaration of general average by Grace Owen, the owner of the Maersk-operated ship involved. Here’s a breakdown of what general average means and why insurance is crucial for cargo owners.

General Average: Sharing the Burden

In response to this extraordinary event, a major shipping line involved in the incident has declared “general average.” This is an old principle in maritime law, originating from ancient Greek law, that applies when a “sacrifice” is made for the common safety of a voyage. Originally the law was intended for cases in which a crashed vessel may need to jettison loads in order to lighten a grounded vessel or a fire onboard might jeopardize cargo to water damage. Today, general average applies more often to the costs associated with repairing a ship or remediating a causeway after a crash. Under general average, all cargo owners on board affected vessels would be financially responsible for a share of these costs, proportional to the value of their cargo.

What it Costs and What to Do About It

General average can come as a nasty surprise for shippers who haven’t planned for it. While the shipping line will manage the salvage operation, the costs will ultimately be shared among all cargo owners. This could lead to significant unexpected expenses for businesses depending on the value of their goods and the extent of the damage.

This is where cargo insurance becomes vital. A cargo insurance policy will typically cover losses arising from general average declarations, protecting shippers from this financial burden. Without insurance, the cost of repairs or abandoned cargo could fall squarely on the shoulders of the shipper, potentially leading to severe financial losses.

US-Mexico Trade Booms, Laredo Maintains Top Spot

The economic relationship between the United States and Mexico continues to strengthen, with trade between the two nations hitting new highs. According to recent data, US-Mexico trade surged to a staggering $67 billion in February 2024, a significant increase compared to the same period last year. This growth trajectory reflects a post-pandemic economic rebound and highlights the deep economic integration between the two North American neighbors.

Looking deeper into the data, US exports to Mexico reached $38 billion in February, representing a 17% year-over-year increase. This growth is likely fueled by a combination of factors, including increased demand for American goods in Mexico’s recovering economy and the ongoing boom in e-commerce across the border. On the import side, Mexico sent $29 billion worth of goods to the US in February, a 19% increase compared to February 2023. This rise suggests a strong US appetite for Mexican products, which range from agricultural goods and manufactured components to finished consumer products.

The Laredo, Texas port of entry continued its strong performance as a leader in US international trade. In February, the trade value increased by 10.3% year-over-year, reaching $27 billion. This marks the eleventh consecutive month that Laredo has held the top spot among the nation’s 450 ports of entry, including airports, ocean ports, and border crossings.

The robust trade relationship between the US and Mexico provides significant economic benefits for both countries. American businesses gain access to a large and growing market for their products, while Mexican producers find a reliable and lucrative export destination. Additionally, the integration of manufacturing supply chains across the border fosters economic growth and job creation in both nations.