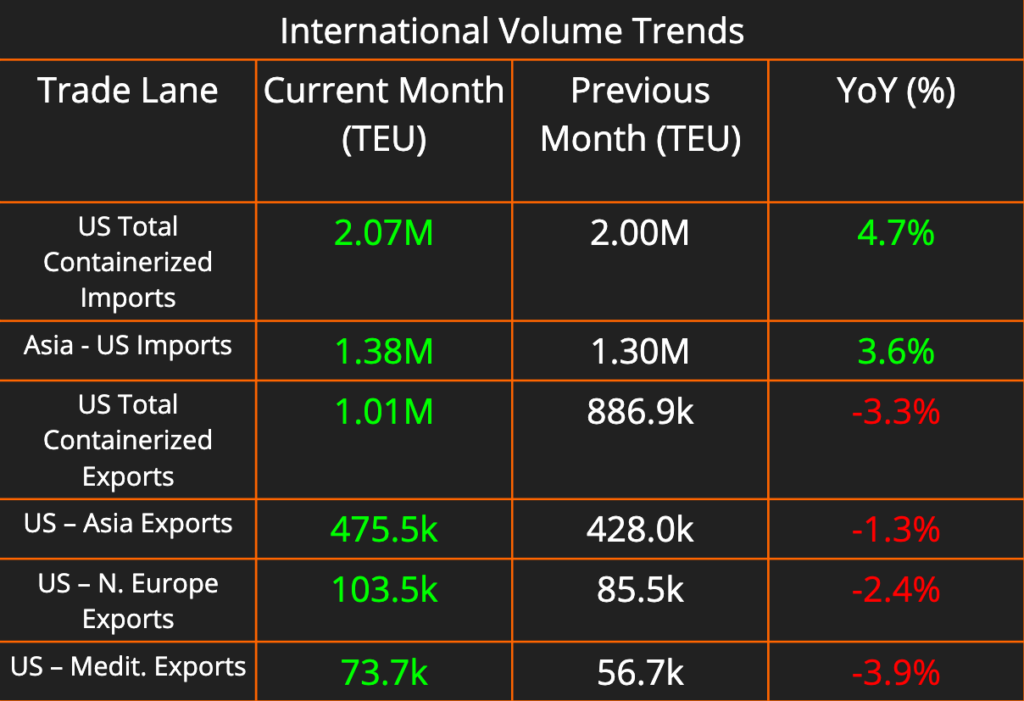

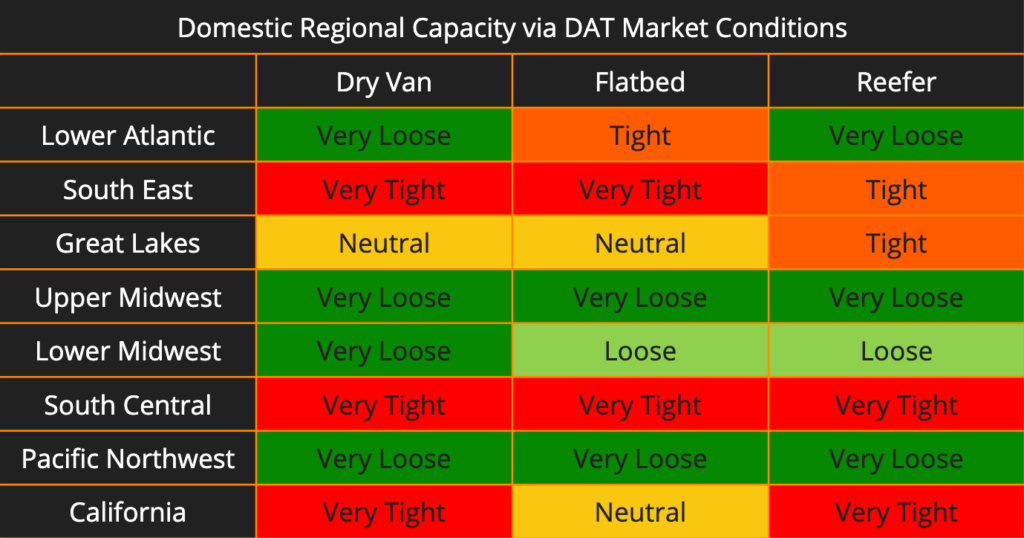

The shipping industry is seeing a surge in activity! Import and export volumes are climbing, with exports experiencing a particularly strong 14% month-over-month jump. Domestically, flatbed and reefer capacity is tightening in many regions as construction and produce seasons kick off. On a brighter note, diesel prices continue their downward trend, reaching their lowest national average cost per gallon since January.

This week, Washington announced new tariffs on Chinese imports. We’ll break down the details and potential impacts. Additionally, we explore the surge in air cargo demand and pricing in the first half of 2024, fueled by the ongoing e-commerce boom.

We are seeing a few changes week-over-week. In the flatbed market, where we are seeing construction season begin in earnest, the Lower Atlantic swung from Very Loose to Tight in an 8-day span. Additionally, the previously tight Great Lakes region downgraded to neutral. One major change on the reefer side is that the Lower Midwest downgraded to Loose from Neutral. In terms of regional trends, California remains very tight in capacity for Dry Van and Reefer. The South Central and Southeast regions are red-hot with produce in full swing.

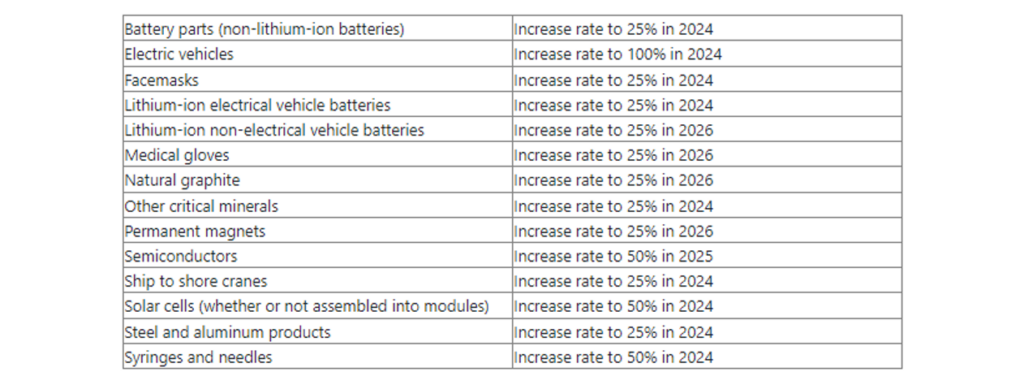

Washington Announces New Tariffs on Chinese Goods

On May 14th, 2024, U.S. Trade Representative Katherine Tai released a statement advising that further action will be taken regarding Section 301 tariffs imposed against goods manufactured from the Peoples Republic of China (PRC). Section 301 tariffs were first introduced in 2018 by President Trump to combat China’s acts, policies and practices related to Technology Transfers, Intellectual Property Rights, and Innovation. After a four-year review of the tariffs, it has been found that while the tariffs have been effective in encouraging PRC to take action regarding these issues, further measures are required.

Below you can find a list of the key sectors that will be affected by the proposed changes and the link to the USTR press release.

Next week, the official Federal Register notice will be issued with more information outlining procedures for public comments and exclusion processes.

Air Cargo Demand Soars on E-commerce Boom

The airfreight industry is experiencing a surprising surge in May, continuing a strong upward trend that began earlier this year. This growth is largely driven by the booming e-commerce sector, according to data from rate benchmarking platforms Xeneta and WorldACD.

Year-over-year cargo demand rose by 11% in April, marking the fourth consecutive month of double-digit growth. This positive momentum has carried over into May, with early data showing volumes up between 12% and 16%.

This trend represents a significant recovery from the downcycle that began in 2022. It’s also reflected in improving financial results for airlines. Cargo revenue declines for the first quarter of 2024 were much narrower compared to the previous year. For instance, Air France-KLM’s cargo revenue decline narrowed from 23% in Q4 2023 to 16.5% in Q1 2024.

The good news extends to cargo spot rates, which are finally showing signs of stabilization. After a significant drop in 2022, spot rates are currently on par with pre-downturn levels. Notably, the benchmark China-North America spot rate index has risen to $5.86 per kilogram as of May 12th, representing a nearly $1.80 increase per kilogram year-over-year.